CGI Group (TSE: GIB.A) (NYSE: GIB), one of the world’s largest IT and business consulting firms, has entered into an agreement to acquire, through its subsidiary CGI France SAS, all the shares of Umanis.

Leader in Data, Digital and Business Solutions

Umanis specializes in data, digital and business solutions, with annual revenues of approximately €246 million, and has been operating for more than 30 years, mainly in the French market.

The contemplated transaction would value the entire share capital of Umanis at approximately €310 million on a fully diluted basis (excluding treasury shares) and represents a premium of 45.96% compared to the last closing price of Umanis on March 10, and 30.4% compared to the volume-weighted average closing price of the last 30 trading days.

As part of this agreement, CGI France has entered into exclusive negotiations to acquire all of the shares held by MURA and by Mr. Olivier Pouligny representing approximately 70.6% of the capital of Umanis at a price of €17.15 per share (the Block Purchase).

Subject to the completion of the Block Purchase, CGI France plans to launch a mandatory tender offer to acquire the remaining shares of Umanis at a price of €17.15 per share and subject to the legal and regulatory conditions being met, will implement a squeeze-out in order to acquire the shares that have not been acquired under the Offer.

The Block Purchase and the filing of the Offer with the Autorité des Marchés Financiers should be completed by the end of the second quarter of calendar year 2022.

CEO Commentary

CGI president and CEO George Schindler said, “The combination of CGI’s operations and those of Umanis will further deepen our presence and positioning across Western and Southern Europe. This transaction is consistent with the metro market merger element of our Build and Buy strategy for delivering profitable inorganic growth, while acting as a catalyst for future organic growth.”

Wall Street’s Take

Last month, Raymond James analyst Steven Li kept a Buy rating on GIB.A, with a price target of C$130. This implies 25.6% upside potential.

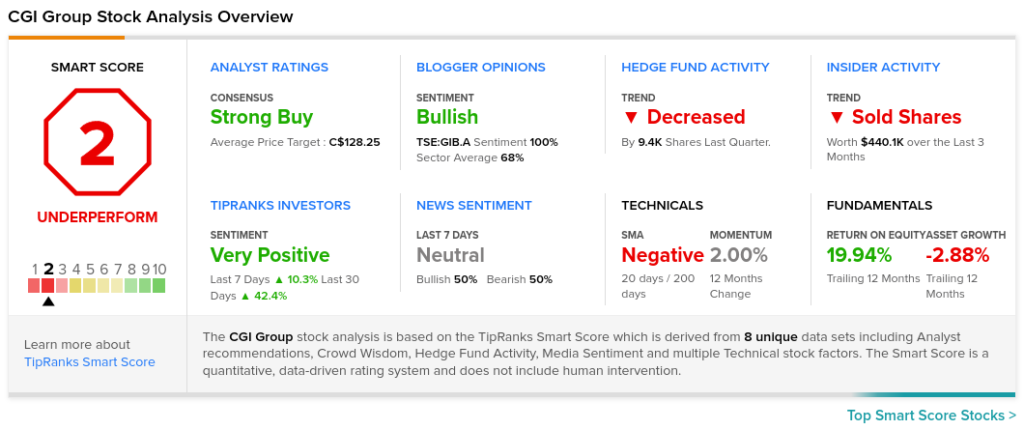

Overall, consensus on the Street is that GIB.A is a Strong Buy based on seven Buys and one Sell. The average CGI Group price target of C$128.25 implies an upside potential of 23.9% to current levels.

TipRanks’ Smart Score

GIB.A scores a 2 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock returns are likely to be lower than the overall market.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Related News:

Docebo Q4 Revenue Grows 59%, Loss Widens

Quebecor Reports Higher Q4 Profit, Dividend Rises 9%