Energy drink sales in the U.S. dipped 1.1% year-over-year in the four weeks ending August 10, according to Nielsen. However, Celsius Holdings (CELH) outperformed its peers with an 8.8% jump in sales, although this was slower than the 12.3% growth it saw in the previous period. When breaking down the numbers even further, Celsius boosted its volume by 16.6% but saw its prices drop by 7.8%. Overall, this gave the brand a 9.6% share of the U.S. energy drink market. Still, CELH shares are down at the time of writing.

Other brands that saw their sales rise included Bang Energy and Red Bull, which came in at 6% and 1.8%, respectively. Monster Beverage (MNST), which bought Bang Energy last year for $362 million, saw sales (excluding Bang) fall by 3.5%.

After the Nielsen report, Morgan Stanley kept its Equal-weight rating on Celsius Holdings. Analyst Eric Serotta mentioned that while Celsius could still grow its U.S. market share to the mid-teens, it might take longer than expected. He also pointed out the risks of slow category growth and tougher competition, which could hold Celsius back.

Is CELH Stock a Good Buy?

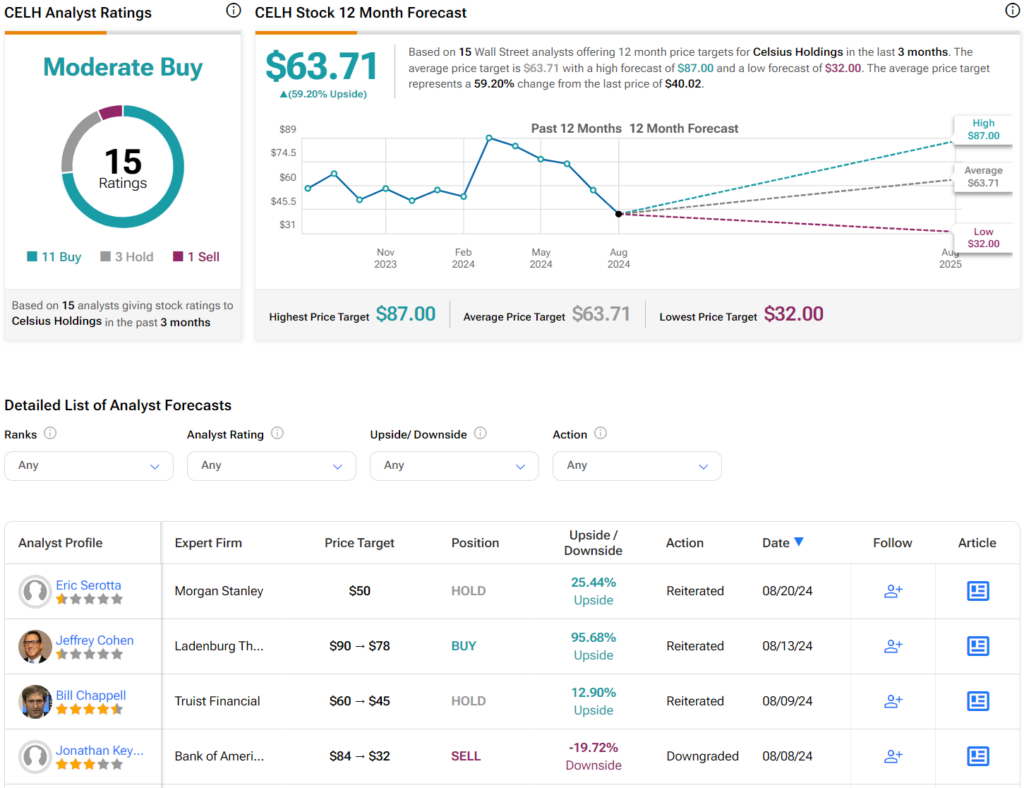

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CELH stock based on 11 Buys, three Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 33% decline in its share price over the past year, the average CELH price target of $63.71 per share implies 59.2% upside potential.