Shares in Cellectis (CLLS) dropped 13% in extended market trading on Monday after the biotech company announced that its MELANI-01 clinical trial for the treatment of cancer has been put on hold by the U.S. Food and Drug Administration (FDA).

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The stock fell to $16.50 in after-market trading. The FDA stopped the trial of one of the three Cellectis product candidates currently in clinical studies, after one patient with relapsed and refractory multiple myeloma treated at dose level two (DL2), suffered from a fatal heart attack.

The patient had been treated unsuccessfully, prior to enrollment in the MELANI-1 trial with numerous lines of prior therapy, including autologous CAR T-cells. Clinical evaluation of the case is ongoing and additional details as to the immediate and underlying causes of this event are being collected, the gene-editing pioneer said.

“We share the FDA’s commitment to patient safety and are working collaboratively with the agency and the investigators to resolve this clinical hold,” said Chief Medical Officer Carrie Brownstein. “The safety of patients enrolled in our clinical trials is our utmost priority and we at Cellectis remain committed to safely resuming the clinical development of UCART product candidate targeting CS1 for patients with multiple myeloma and unmet medical need.”

Multiple myeloma is a cancer that affects a type of white blood cells called plasma cells that are specialized mature B-cells, which secrete antibodies to combat infections.

Cellectis added that the company is working closely with the FDA to address the agency’s requests including changes to the MELANI-01 clinical protocol designed to enhance patient safety, and expects to submit requested information including an amended protocol in due course.

Shares in Cellectis have been on a steep gaining path since hitting a low in March and are now trading 11% higher than in the beginning of the year.

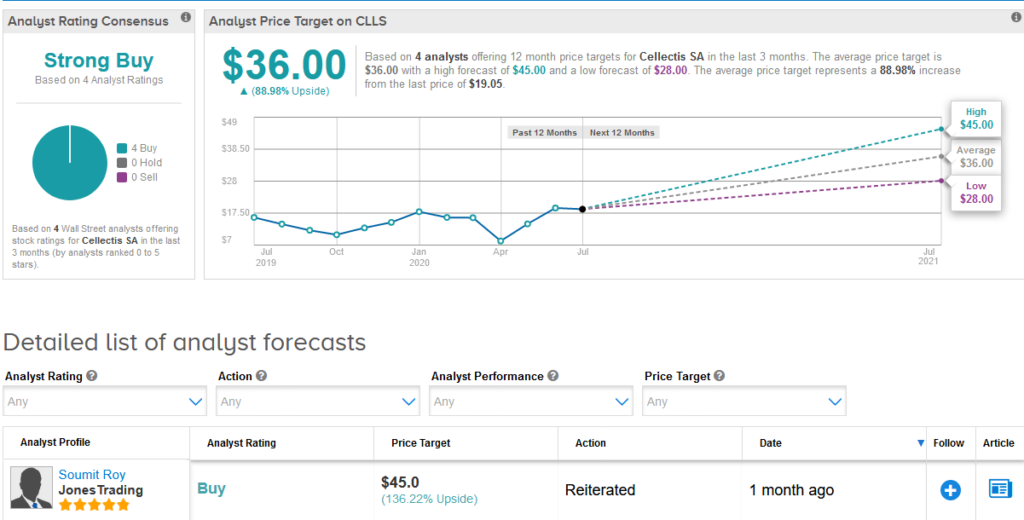

Up until the announcement analysts had a bullish outlook on the stock boasting 4 unanimous Buy ratings making it a Strong Buy consensus. Looking ahead, they forecast more gains for investors. The $36 average price target implies 89% upside potential from current levels. (See Cellectis stock analysis on TipRanks)

Five-star analyst Soumit Roy at JonesTrading last month reiterated a Buy rating on the stock with a bullish $45 price target (136% upside potential), saying Cellectis is well positioned as a M&A target following potentially positive data in 4Q20 and mid-2021 .

“We view Cellectis to be leading the allogeneic CAR T space with meaningful data in 4Q20 & 1H21 from three wholly owned assets in r/r AML, r/r multiple myeloma and r/r adult ALL, and any positive data in the allogeneic space likely to be positive for Cellectis’ stock,” Roy wrote in a note to investors.

Related News:

Chembio Gains 12% After-Hours On New Covid-19 BARDA Contract

CytoDyn Signs Distribution Deal For Covid-19 Treatment Leronlimab

Gilead’s Covid-19 Remdesivir Therapy Gets Conditional European Nod