Cathie Wood’s Ark Invest ETFs offloaded Palantir Technologies (PLTR) stock ahead of its Q3 earnings while continuing to trim its Tesla (TSLA) holdings. The details were released in a regulatory filing based on trades made on Friday, November 1. Wood sold 227,699 shares, valued at $9.46 million, of the data analytics firm.

Ark has been slowly unwinding its stake in Palantir ahead of the company’s earnings due today, November 4. The Street expects Palantir to post adjusted earnings of $0.09 per share on sales of $705.11 million. Wood could be capitalizing on the fresh 52-week high hit by Palantir stock last week. Year-to-date, PLTR shares have gained 152.8%.

Is Palantir a Good Stock to Buy?

Currently, analysts prefer to remain on the sidelines on Palantir stock. On TipRanks, PLTR stock has a Hold consensus rating based on four Buys, seven Holds, and six Sell ratings. The average Palantir Technologies price target of $27.85 implies 33.6% downside potential from current levels.

Is Tesla a Buy, Sell, or Hold?

Wood’s Ark ETFs have been steadily trimming Tesla stock, leveraging the recent post-earnings stock price surge. On Friday, Ark Invest sold 30,597 shares of Tesla, valuing the sale at $7.64 million.

On TipRanks, TSLA stock has a Hold consensus rating based on 11 Buys, 16 Holds, and eight Sell ratings. The average Tesla price target of $207.83 implies 16.5% downside potential from current levels. Meanwhile, TSLA shares have gained 34.8% in the past six months.

Wood’s Other Notable Trades on November 1

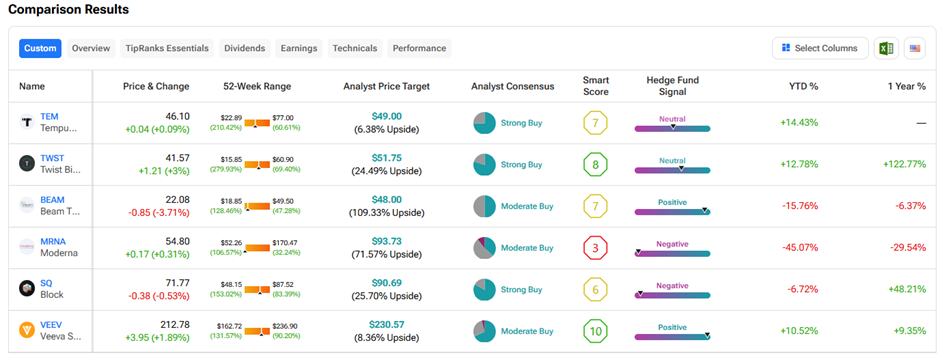

Turning toward the buy side, ARK ETFs bought an additional 53,983 Tempus AI (TEM) shares worth $2.41 million. Wood also bought additional shares of Twist Bioscience (TWST) and Beam Therapeutics (BEAM), while selling shares of Moderna (MRNA), Block (SQ), and Veeva Systems (VEEV), among others.

Questions or Comments about the article? Write to editor@tipranks.com