Down by nearly 22% over the past two trading sessions, CrowdStrike (NASDAQ:CRWD) stock is riding the rollercoaster of investor sentiment. The sharp decline came after it was revealed that a glitch in a software update from the cybersecurity specialist caused a massive global IT meltdown, impacting multiple industries.

So, what’s next? Apart from a fix for the issue and reassurances from CrowdStrike’s CEO that no hack occurred, it’s shopping time for some investors.

Among them is Cathie Wood, CEO of Ark Invest, who saw the pullback as an opportunity to load up on the cheap. On Friday, she swiftly got the proverbial checkbook out and purchased two tranches of CRWD shares: one consisting of 27,061 shares (worth $8.25 million) for her ARKW (ARK Next Generation Internet) ETF, and another of 11,534 shares (worth nearly $3.52 million) for her ARKF (ARK Fintech Innovation) ETF.

It’s hardly surprising to see Wood making these purchases as the stock has obvious ingredients that appeal to Wood – CrowdStrike is a tech innovator and leader in its field that has taken a beating.

An undeserved one at that, according to Rosenblatt analyst Catharine Trebnick, whose words mirror the ARK Invest CEO’s actions, with the analyst pointing investors toward a stock going for a discount rate.

“The market’s knee-jerk reaction to the CrowdStrike glitch creates a window for investors to buy into a high-quality, growth-oriented cybersecurity company at a discounted valuation, said the analyst. “CrowdStrike’s swift response and the essential nature of their services reinforce their market dominance and long-term growth potential, making this a prime opportunity for long-term investors,” Trebnick opined.

To this end, Trebnick maintained a Buy rating on CRWD shares along with a $420 price target. The implication for investors? Upside of 38% from current levels. (To watch Trebnick’s track record, click here)

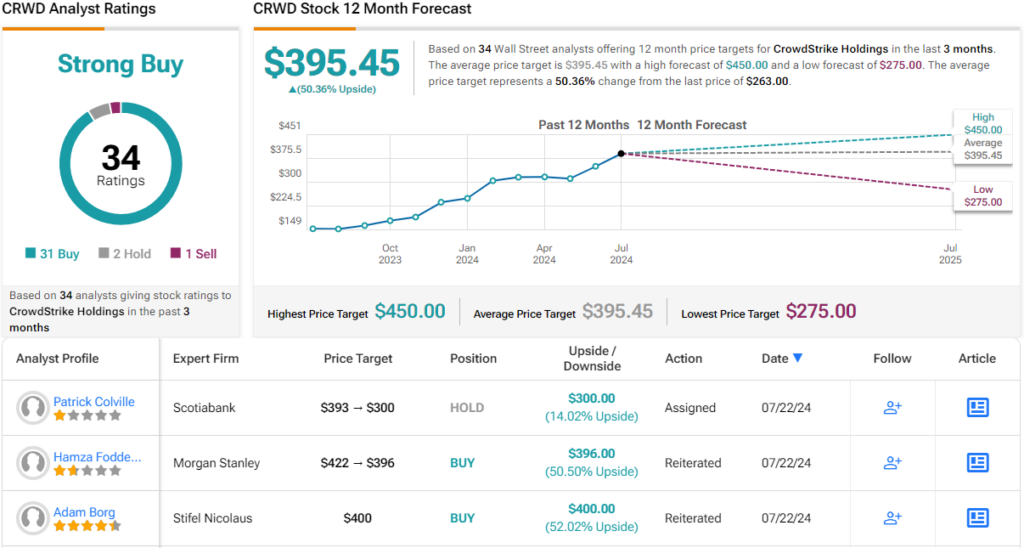

Trebnick’s take is hardly unique on Wall Street. 30 other analysts join her in the bull camp, and they are countered by just 2 Holds and 1 Sell, all naturally coalescing to a Strong Buy consensus rating. Moreover, there are nice gains projected here; at $395.45, the average target implies shares will post growth of ~50% over the one-year timeframe. (See CrowdStrike stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.