Ark Invest founder and CEO Cathie Wood recently compared the current search for safety in the equity market—in this case, measured by the market’s concentration in top stocks—to the panic seen during the Great Depression. In a message and video posted on X, Wood highlighted a Goldman Sachs chart showing that the concentration of market capitalization in the largest U.S. stocks is now at 33%, the highest in decades. She explained that in 1932, fear led to a similar focus on a few “safe” stocks.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

As a current example, she noted that despite the S&P 500 (SPX) slipping from a record high due to rate-cut uncertainty, Nvidia’s (NASDAQ:NVDA) stock surged past $1,000 for the first time, boosting its market cap to over $2 trillion.

However, from 1939 to 1946, these large-cap stocks underperformed compared to the broader market. Wood believes that the current market, which is being driven by indexation and momentum, will broaden and become healthier as interest rates decline.

What Is the Future of ARKK Stock?

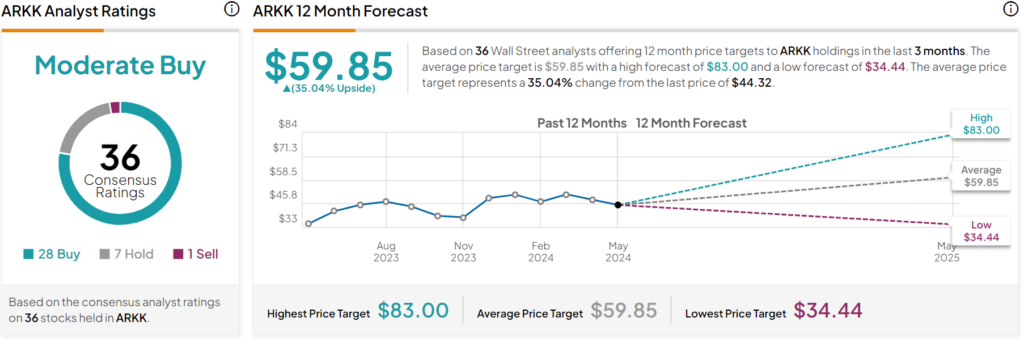

Turning to Wall Street, analysts have a Moderate Buy consensus rating on Cathie Wood’s flagship fund, the Ark Innovation ETF (ARKK), based on 28 Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 14% year-to-date decline, the average ARKK price target of $59.85 per share implies 35.04% upside potential.