Catalyst Pharmaceuticals (NASDAQ:CPRX) has attracted investors’ interest as a high-performing biopharmaceutical company, with its first-quarter results for 2024 outperforming analysts’ predictions. This is a continuation of the company’s impressive revenue growth over the past five years, which has driven a substantial 330% increase in the share price. The stock trades at a discount to industry peers and presents a compelling growth-oriented value investment opportunity.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Catalysts’ Lead Treatment Expands

Catalyst Pharmaceuticals is a commercial-stage biopharmaceutical company focused on developing and commercializing novel medicines for treating rare diseases. Its lead treatment, FIRDAPSE, is a medication designed for the treatment of adults and children aged six to seventeen suffering from Lambert-Eaton myasthenic syndrome (LEMS), which disrupts communication between the nerves and the muscles.

Recently, the FDA approved an increased daily dose of FIRDAPSE for adults and pediatric patients weighing more than 45 kg, from 80 mg to 100 mg. This recent approval further expands the approved dosing options available for healthcare providers treating LEMS, and provide great potential for growth.

Catalyst’s Recent Financial Results

The company recently released its first-quarter results for 2024. Reported revenue was $98.51 million, slightly beating analysts’ predictions of $98.13 million while marking a 15.4% year-over-year increase from $85.4 million in 2023. Non-GAAP net income remained steady at $46.8 million for Q1 2023 and Q1 2024. Earnings per share (EPS) of $0.38 exceeded analysts’ estimates of $0.17.

The company completed the quarter with cash and cash equivalents amounting to $310.4 million.

Also, management has issued guidance for the rest of the Fiscal year, with total revenue anticipated to be between $455 million and $475 million.

What Is the Price Target for CPRX Stock?

Analysts following the company have been constructive on the stock. H.C. Wainwright’s Andrew Fein, a five-star analyst according to Tipranks ratings, recently reiterated a Buy rating on the stock and has a $26.00 price target. He predicts the FDA’s approval for an increased daily dose of FIRDAPSE will aid with growth enhancement

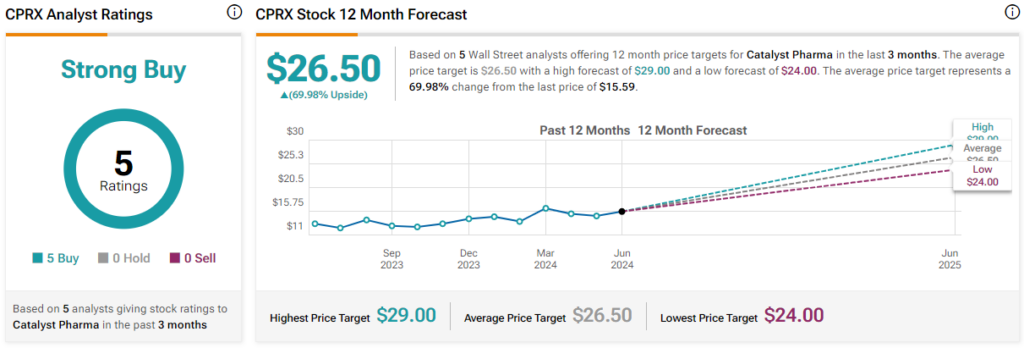

Overall, Catalyst Pharma is rated a Strong Buy, based on the recommendations and price targets assigned by five analysts over the past three months. The average price target for CPRX stock is $26.50, representing a potential upside of 69.98% from current levels.

The stock has been trending upward, climbing over 20% in the past year. It sits in the upper end of its 52-week price range of $11.55 – $17.50 and continues to demonstrate upward price momentum, trading above the 20-day (15.57) and 50-day (15.62) moving averages. With a P/S ratio of 4.33x, it trades at a relative discount to peers in the Biotechnology industry, where the average P/S ratio is 10.84x.

Closing Thoughts on CPRX

Catalyst Pharmaceuticals has consistently demonstrated strong financial performance, punctuated by recent Q1 results. Recent FDA approval for increased dosing creates the potential for a rise in revenue while the stock trades at a discount to industry peers, making Catalyst an attractive growth-oriented value investment opportunity.