Wolfspeed (WOLF) stock is soaring today on news of a major cash influx from the White House. The Biden-Harris administration has announced that it will be investing $750 Million in the semiconductor producer as part of the CHIPS and Science Act. With this new funding, Wolfspeed will be well-positioned to continue scaling production as the ongoing AI boom boosts demand for its chips.

Passed in August 2022, the CHIPS and Science Act has helped spur growth for many chipmakers. But as a semiconductor manufacturer based in the United States, Wolfspeed is a logical choice to receive funding under it, as helping it grow creates jobs for U.S. workers.

What’s Going On with Wolfspeed?

After spending the past year gradually trending downward, Wolfspeed may be on the path to recovery. As of this writing, WOLF stock is up 21% for the day, and it looks poised to keep rising. Despite its year-to-date decline of 74%, the stock has garnered significant momentum over the past month, rising more than 70%.

This development is in line with President Joe Biden’s commitment to supporting U.S. manufacturing, even as his presidency winds to a close. Indeed, semiconductors are a critical component not just of AI manufacturing but for electric vehicle production and other areas of the clean energy sector.

In a statement from the White House, U.S. Secretary of Commerce Gina Raimondo noted that the CHIPS and Science Act has allowed the United States to build and fortify its semiconductor manufacturing capabilities. This investment is aimed primarily at expanding production at Wolfspeed’s flagship manufacturing base in Durham, North Carolina. But the company is also focused on scaling operations at its Mohawk Valley Fab facility in Marcy, New York.

Is Wolfspeed Stock a Buy, Sell, or Hold?

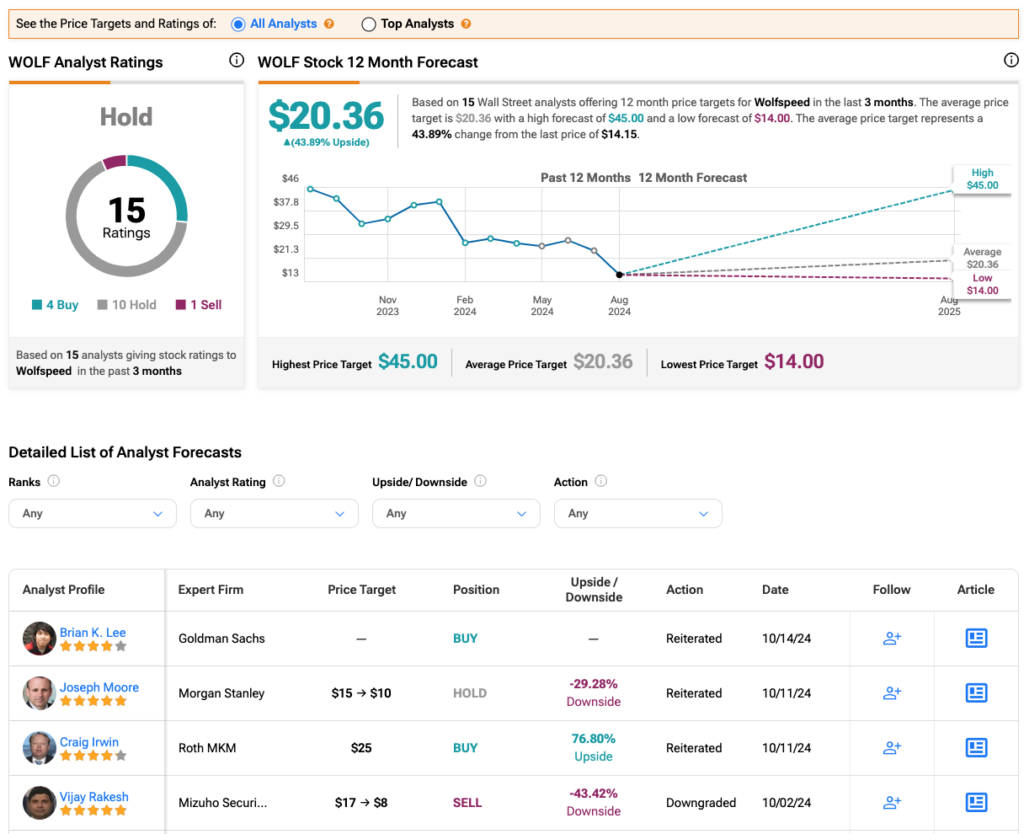

Turning to Wall Street, analysts have a Hold consensus rating on WOLF stock based on four Buys, 10 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. In addition, the average WOLF price target of $20.36 per share implies 43.9% upside potential.

In addition to the White House’s funding package, Wolfspeed will also be receiving a $750 million funding package from several private sector investors. This group includes Apollo, The Baupost Group, and Capital Group, as well as Fidelity Management & Research Company. This cash influx will likely continue to boost WOLF stock as the company works to make up the ground it has lost in 2024.