Shares of used car retailer Carvana (NYSE:CVNA) gained over 2% in after-market trading yesterday after the company swung to profit in the third quarter. CVNA is an online automotive retailer that allows customers to buy, sell, and finance used cars.

CVNA reported earnings of $3.60, compared with the consensus estimate of a loss of $0.70. Also, the reported figure compares favorably with a loss of $2.67 per share. However, the company posted revenues of $2.77 billion in the quarter, down 18% year-over-year, and came below Wall Street’s expectations of $2.81 billion.

The reduction in top-line numbers was due to the 21% decline in retail units sold during the quarter. Additionally, the adjusted gross profit per unit of $6,396 increased by 65%.

For the fourth quarter, Caravana expects a sequential fall in retail units sold, driven primarily by industry and seasonal patterns. Also, it anticipates generating a positive adjusted EBITDA and adjusted GPU of over $5,000 for the third consecutive quarter.

Analyst’s Take

Following the earnings release, Wells Fargo analyst Zachary Fadem maintained a Hold rating on CVNA stock. The analyst expressed his concerns about CVNA’s leveraged balance sheet, which had over $5 billion in debt.

Is Carvana Stock a Buy, Sell, or Hold?

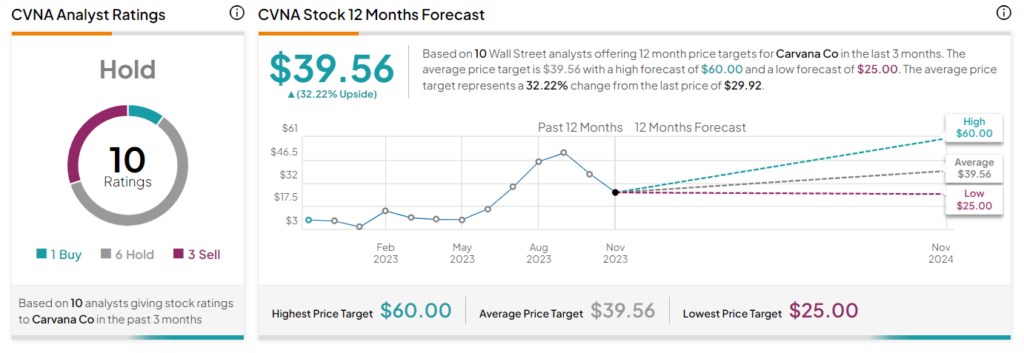

Overall, Carvana stock has a Hold consensus rating based on one Buy, six Holds, and three Sells. The average stock price target of $39.56 implies a 32.2% upside potential. The stock has skyrocketed 546% so far in 2023.