Shares of Maplebear (CART), also known as Instacart, jumped in after-hours trading after the online grocery shopping platform reported earnings for its second quarter of Fiscal Year 2024. Earnings per share came in at $0.20, which beat analysts’ consensus estimate of $0.13 per share. Sales increased by 14.9% year-over-year, with revenue hitting $823 million. This beat analysts’ expectations by more than $18 million.

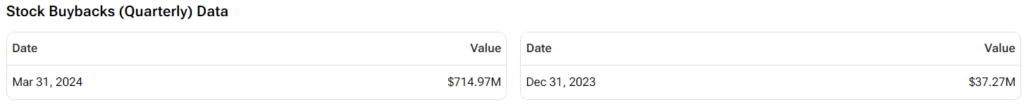

In addition, Maplebear returned $325 million to shareholders, with buybacks making up the entire amount. The company has only recently started repurchasing its shares two quarters ago, which makes this the third quarter it has done so. The largest one came during the first quarter of 2024, when Maplebear repurchased over $700 million worth of shares, as per the image below.

Looking forward, management now expects gross transaction value and adjusted EBITDA for Q3 2024 to be in the ranges of $8.1B to $8.25B and $205 million to $215 million, respectively.

Is CART a Good Stock to Buy?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CART stock based on 11 Buys, eight Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 4% increase in its share price over the past year, the average CART price target of $44.15 per share implies over 40% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.