CarMax (NYSE:KMX) stock is slightly in the green today, but investors would likely be wise to steer clear before the stock potentially crashes. Even if short-term traders didn’t have a negative reaction to CarMax’s recently published financial report, I encourage you to look under the hood and see what’s really going on with CarMax. In the final analysis, I am bearish on KMX stock and view it as susceptible to an imminent drawdown.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

CarMax provides a platform that helps people buy and sell used vehicles. The company is profitable, but this doesn’t necessarily mean CarMax is in ideal financial condition in 2024.

As we’ll see, CarMax’s CEO attempted to spin a notable used-car pricing trend as a positive development. Sure, it’s the CEO’s job to be a hype man for his company, but informed investors should use their own judgment and really think about CarMax’s major challenges.

Are Price Declines an “Encouraging” Trend?

Here’s what caught my attention in the recent commentary of CarMax CEO Bill Nash. He said that he’s “encouraged by the trends we saw in the first quarter” of Fiscal Year 2025, “including continued year-over-year price declines.”

Let me provide a little bit of context here. During the COVID-19 pandemic’s onset in 2020 and 2021, used-car retailers commanded strong pricing power. That’s because supply chains were constrained, used vehicles were harder to obtain, and the supply-demand balance was heavily skewed.

Supply chains have opened up since 2020 and 2021, of course. So, I suppose that budget-conscious vehicle shoppers might be “encouraged” by vehicle price declines. A reduction in pricing power can’t possibly be good for CarMax’s bottom-line results, though.

New vehicles have become more affordable recently, and some vehicle shoppers may take advantage of new-car dealers’ enticing trade-in offers instead of buying a used vehicle through CarMax. Thus, even if Nash is “encouraged by the trends” he’s seeing in the vehicle market, prudent investors shouldn’t take the CEO’s commentary as gospel. Ultimately, the hard data should be your guide. So, let’s take a bumpy road trip, if you don’t mind, and visit CarMax’s quarterly report right now.

CarMax Stock Didn’t Decline (Yet) on Negative Earnings News

As I alluded to earlier, CarMax stock stayed green today after the company released its results for the first quarter of Fiscal Year 2025. Investors shouldn’t immediately jump to any conclusions, however, as CarMax’s quarterly results weren’t great.

First of all, CarMax sold 358,817 vehicles during the quarter, down 5.3% year-over-year. Despite the CEO’s remarks, I’d say that this isn’t an “encouraging” trend. Possibly, it’s a result of CarMax’s diminished pricing power, as we already discussed.

What about the company’s profit margins in the retail used vehicle sector? CarMax reported gross profit per retail used unit of $2,347, “in line with last year,” so there’s no deterioration but also no acceleration. This metric is something that investors should keep an eye on in the upcoming quarters.

Here’s where it really starts to get problematic. In Q1 of FY2025, CarMax’s revenue declined 7.5% year-over-year to $7.11 billion. Furthermore, this result fell short of the analysts’ consensus estimate of $7.16 billion in quarterly revenue.

Turning to the company’s bottom-line results, it’s a “good news, bad news” type of situation. CarMax reported earnings of $0.97 per share, a result that’s slightly above Wall Street’s consensus estimate of $0.95 per share. On the other hand, this result represents a 32.6% year-over-year decline compared to the $1.44 per share that CarMax earned in the year-earlier quarter.

For what it’s worth, CarMax offered an excuse for this subpar earnings result. The company stated, “Last year’s first quarter included a $0.28 benefit in connection with a legal settlement.” Still, even if we subtract that $0.28 from the year-earlier quarter’s earnings result of $1.44 per share, we’d get $1.16 per share. In other words, there’s still a notable year-over-year drop-off in CarMax’s Q1-FY2025 earnings result of $0.97 per share.

Is CarMax Stock a Buy, According to Analysts?

On TipRanks, KMX comes in as a Moderate Buy based on six Buys, four Holds, and one Sell rating assigned by analysts in the past three months. The average CarMax stock price target is $80.30, implying 12.3% upside potential.

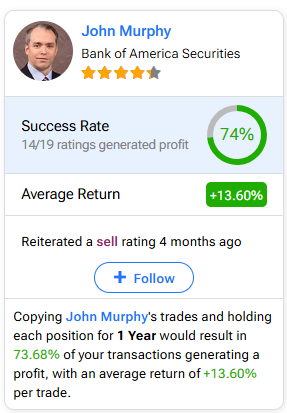

If you’re wondering which analyst you should follow if you want to buy and sell KMX stock, the most accurate analyst covering the stock (on a one-year timeframe) is John Murphy of Bank of America (NYSE:BAC) Securities, with an average return of 13.6% per rating and a 74% success rate. Click on the image below to learn more.

Conclusion: Should You Consider CarMax Stock?

No matter how the company tries to frame it, CarMax suffered a year-over-year fall-off in its revenue and earnings. Plus, the company’s vehicle sales are down. There’s nothing particularly “encouraging” about these hard facts.

I’m actually surprised that CarMax shares didn’t lose significant value today. Maybe there will be a delayed negative reaction from the market.

Investors certainly don’t need to put their portfolios in a vulnerable position right now. Therefore, I am bearish on KMX stock and definitely wouldn’t consider taking a long position today.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue