Earlier today, Cargojet (TSE: CJT) (OTC: CGJTF), a Canadian air transportation services company, reported its Q4-2022 earnings results, which beat revenue expectations but missed earnings-per-share (EPS) expectations by a large amount. As a result, the stock finished 10.8% lower.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

CJT’s revenue reached C$267 million compared to the consensus estimate of about C$260.6 million, representing a 13.2% growth rate.

However, CJT’s adjusted earnings per share were C$0.90, down 63.7% year-over-year, missing estimates of C$2.05. Likewise, the company’s gross profit margin was 23.2% compared to 33.1% last year.

CJT’s adjusted free cash flow also fell, coming in at C$33.6 million for the quarter, down 11.1%. Nonetheless, while free cash flow was lower, cash from operations actually grew from C$61.2 million to C$64.2 million. Lastly, adjusted EBITDA was C$82.9 million, down from Q4-2021’s figure of C$90.5 million, while its adjusted EBITDA margin fell to 31% compared to 38.4% one year earlier.

Overall, CJT is still expecting solid growth in the coming years. In late September, the company outlined ambitious targets for 2026, which made the stock rally. However, there’s one important thing to note. Management talked about these targets in the earnings call that took place earlier today, and essentially, they realized that they were too optimistic. Therefore, they pushed their 2026 targets out by approximately one year. This is likely another reason why the stock felt so much pain today.

Is Cargojet Stock a Buy, According to Analysts?

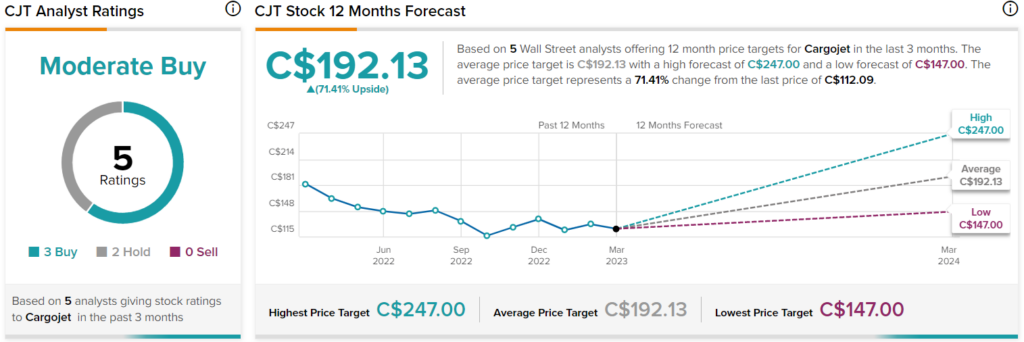

According to analysts, Cargojet stock earns a Moderate Buy consensus rating based on three Buys and two Holds assigned in the past three months. The average Cargojet stock price forecast of C$192.13 implies 71.4% upside potential. Analyst price targets range from a high of C$247 to a low of C$147.