Canopy Growth (TSE: WEED) (NASDAQ: CGC), one of the world’s largest cannabis companies, will report its Q3 earnings on February 9 before the opening bell.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The pot stock has lost approximately 9.5% year-to-date and is currently trading close to C$10. Strong earnings could boost WEED shares, so let’s have a look at what analysts are expecting.

Analysts Estimates

According to the Zacks Consensus Estimate, Canopy Growth is expected to post a loss of $0.23 per share in Q3 2022, compared to a loss of $0.98 in the prior-year quarter. The estimate for revenue is $110.6 million, indicating a decrease of 5.51% from the third quarter of 2021.

Points to Watch

Canopy Growth is expected to experience continued strong demand for legal cannabis products in the growing Canadian recreational cannabis market.

The company kept its leadership in terms of market share in the premium flower category.

The company also increased its market share in vapes and edibles categories.

In edibles, the launches of products like Deep Space XPRESS, Ace Valley Dream CBN, and Super CBD gummies in the Canadian market likely helped the company’s performance in the third quarter.

Wall Street’s Take

On February 3, CIBC analyst John Zamparo kept a Sell rating on WEED and lowered its price target to C$9 (from C$12). This implies 10% downside potential.

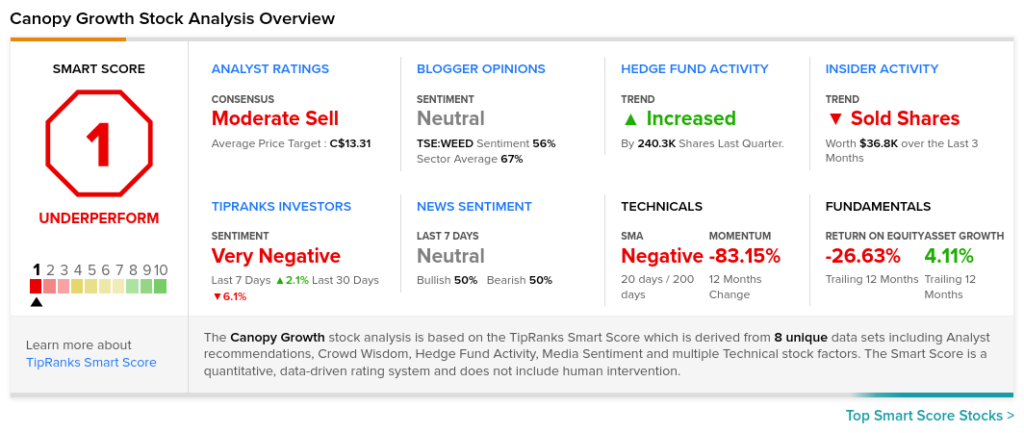

Overall, WEED scores a Moderate Sell rating among Wall Street analysts based on one Buy, five Holds, and six Sells. The average Canopy Growth price target of C$13.31 implies 33.3% upside potential from current levels.

TipRanks’ Smart Score

Canopy Growth scores a 1 out of 10 on TipRanks’ Smart Score rating system, indicating that its stock has a good chance of performing worse than the overall market.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Related News:

Concerned Shareholder Calls for Board Changes at HEXO

High Tide Revenue Rises 118% in FY 2021