Right now, the mood in the Canadian oil market is upbeat among Bay Street analysts. However, despite this sentiment, three major Canadian oil stocks—Suncor Energy (TSE:SU), Athabasca Oil (TSE:ATH), and Cenovus Energy (TSE:CVE)—are down in Friday morning’s trading.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

With the Trans Mountain Pipeline expansion up and running, crude oil in Alberta is likely to get a nice revival, as there should be quite a bit more of it reaching customers. And all three of the aforementioned oil companies are likely to show some positive results as their earnings reports are set to hit at the end of October.

Better yet, oil prices in Canada stayed relatively flat; North American benchmark oil actually slipped a bit, down around 6% between the second and third quarters. This means that Canada can effectively realize a little more for its oil, as the oil it pumps has not been subject to the same price decline seen in the broader North American market.

An Unexpected Boost

Moreover, Canadian oil is proving oddly attractive to the United States market. While the North American benchmark price is down about 6%, as noted previously—based on a report from The Institute for Energy Research—America is still importing huge amounts of oil from its neighbor to the north.

In fact, as of July, the United States brought in 4.37 million barrels per day of Canadian oil, which turned out to be a record. That was over 10 times the amount that Alaska chipped in and proved a welcome support as the Biden-Harris administration shut down several oil prospects. And while the Biden-Harris administration also put the kibosh on the Keystone XL pipeline, oil continues to reach the United States anyway from other pipelines as well as by rail.

Which Canadian Oil Stocks Are a Good Buy Right Now?

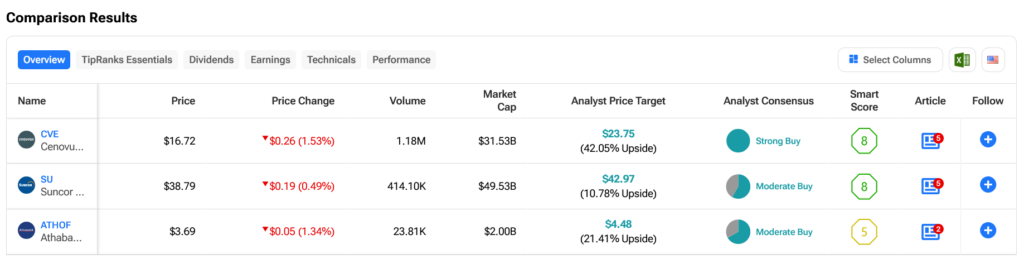

Turning to Wall Street, the leader among three major Canadian oil stocks right now is Cenovus Energy. A Strong Buy-rated stock with an average price target of $23.75 per share, it has a 42.05% upside potential. Meanwhile, the laggard among the three is the Moderate Buy-rated Suncor Energy, which offers a 10.78% upside potential against its average price target of $42.97 per share.