Kansas City Southern (KSU) has inked a deal to merge with Canadian National Railway (CNI) to produce a world-class railway for a consideration of $33.6 billion. Shares of KSU have jumped 92.1% over the past year.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Per the terms of the cash and stock combination deal, KSU shareholders will get $200 in cash and 1.129 shares of CNI for every KCU share held. Additionally, preferred shareholders will receive $37.50 in cash for each preferred share.

Notably, KSU shareholders are expected to receive the equivalent of $2.30 in annual dividends per KSU share based on CNI’s current quarterly dividend of C$0.615.

The valuation indicates a 45% premium to the KSU closing share price as of March 19, 2021. (See KSU stock analysis on TipRanks)

KSU shareholders will own 12.6% of the merged entity and the transaction is expected to complete in the second half of 2022.

The deal is expected to be accretive to CNI’s EPS from the very first year with double-digit EPS growth expected in the future years once synergies are completely utilized.

Furthermore, EBITDA synergies are expected to approach $1 billion annually, mostly driven by incremental revenue opportunities. Post the merger, the combined entity’s total addressable market (TAM) is targeted at $8 billion.

The deal was unanimously approved by the Board of Directors of both the companies and awaits certain regulatory approvals.

KSU’s CEO Patrick J. Ottensmeyer commented, “As North America’s most customer-focused transportation provider, we are excited about this combination with CNI, which will provide customers access to new single-line transportation services at the best value for their transportation dollar, and increase competition among the Class 1 railroads.”

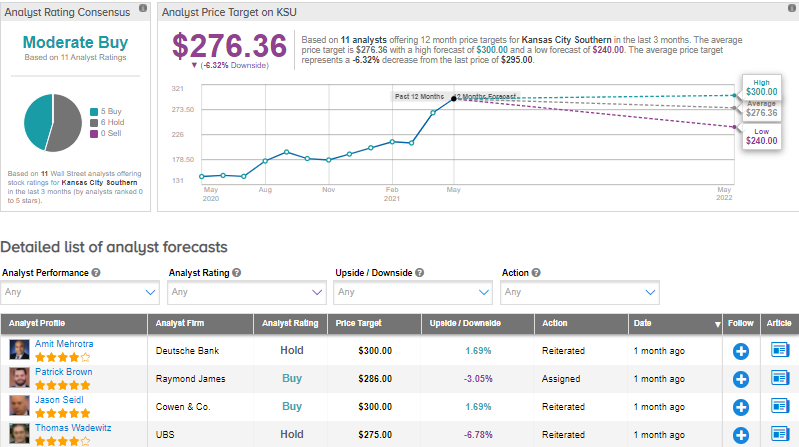

On April 26, Deutsche Bank analyst Amit Mehrotra increased the price target on the stock from $212 to $300 (1.7% upside potential) and reiterated a Hold rating.

Mehrotra said that though the rail companies faced disruptions resulting in poor first-quarter results, he believes the outlook remains more positive.

Overall, the stock has a Moderate Buy consensus rating based on 5 Buys and 6 Holds. The average analyst price target of $276.36 implies 6.3% downside potential from current levels.

Related News:

Cisco’s Q4 Earnings Outlook Miss Estimates After Q3 Beat; Shares Drop After-Hours

Shoe Carnival Posts Quarterly Beat As Sales Improve, Q2 Revenue Outlook Disappoints

Lennox Bumps Up Quarterly Dividend By 19%