Canada Goose Holdings (GOOS) revenues increased in the second quarter, driven by a surge in online sales and strong demand for its luxury parkas as economies reopen. Based in Toronto, Canada Goose is one of the world’s largest extreme weather outerwear retailers.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Revenue & Earnings

Revenue for Q2 2022 came in at C$232.9 million, an increase of 19.6% from C$194.8 million. Global e-commerce revenue rose 33.8%.

Both direct-to-consumer (DTC) sales and wholesale revenue increased in the quarter ended September 26. DTC revenue rose 80.1% to C$83.2 million, driven by higher sales from existing retail stores, e-commerce growth, and store openings. DTC revenue in Mainland China increased by 85.9%.

Wholesale revenues increased 24.8% to C$147.9 million thanks to an earlier schedule of shipping orders relative to fiscal 2021.

Net income amounted to C$9 million (C$0.08 per diluted share), compared to C$10.4 million (C$0.09 per diluted share) in the second quarter of 2021.

Non-IRFS adjusted net income was C$0.12 per share in the quarter, up from C$0.10 per share a year ago.

Raises Fiscal 2022 Outlook

Canada Goose president and CEO Dani Reiss said, “Our second quarter results demonstrate our momentum. Across all channels, we are seeing strong leading indicators of peak season demand. With accelerating DTC trends, growing lifestyle relevance and unique supply chain flexibility, we believe we have the right foundation in place for an outstanding fiscal 2022.”

The company raised its fiscal 2022 outlook. It now expects total revenue of C$1.125 billion to C$1.175 billion, compared to over C$1 billion, and non-IFRS adjusted net income per diluted share from C$1.17 to C$1.33. (See Insiders’ Hot Stocks on TipRanks)

Analyst Recommendations

On November 1, CIBC analyst Mark Petrie reiterated a Buy rating on GOOS with a price target of C$60. This implies 1% downside potential.

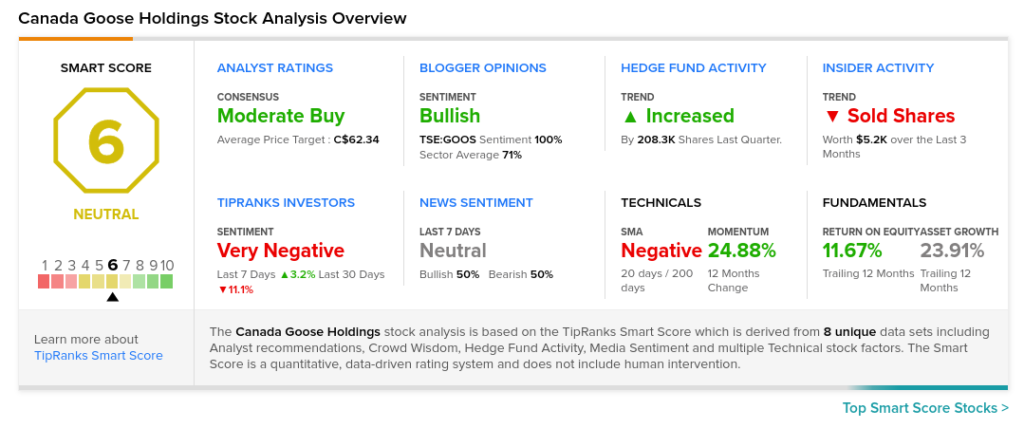

The rest of the Street is cautiously optimistic on GOOS with a Moderate Buy consensus rating based on six Buys and three Holds. The average Canada Goose price target of C$62.34 implies upside potential of 2.6% to current levels.

TipRanks’ Smart Score

GOOS scores a 6 out of 10 on the TipRanks Smart Score rating system, indicating that the stock returns should perform in line with the overall market.

Related News:

Lightspeed Posts Wider Loss in Q2; Shares Plunge

Shopify Q3 Revenue and Profit Miss Estimates

Sleep Country Canada Buys Sleep Retailer Hush Blankets