Canada Goose (TSE:GOOS) (NYSE:GOOS) shares surged nearly 7% today after the luxury and lifestyle products provider announced its results for the third quarter. Amid a challenging consumer spending environment, revenue increased by 6% year-over-year to C$609.9 million. Further, EPS ticked up by C$0.01 to C$1.29.

During the quarter, DTC revenue increased by 14% to C$514 million. However, lower eCommerce sales led to a 1.6% drop in DTC comparable sales. Still, the company’s Asia Pacific revenue soared by 62% with growth across all channels. In contrast, its EMEA and North America revenue declined by 26% and 14%, respectively.

For the upcoming quarter, Canada Goose expects total revenue in the range of C$310 million to C$330 million. Non-IFRS adjusted EPS is seen landing between C$0.02 and C$0.13. For the full year, total revenue is anticipated to be between C$1.28 billion and C$1.30 billion, while non-IFRS-adjusted EPS is expected to hover between C$0.82 and C$0.92.

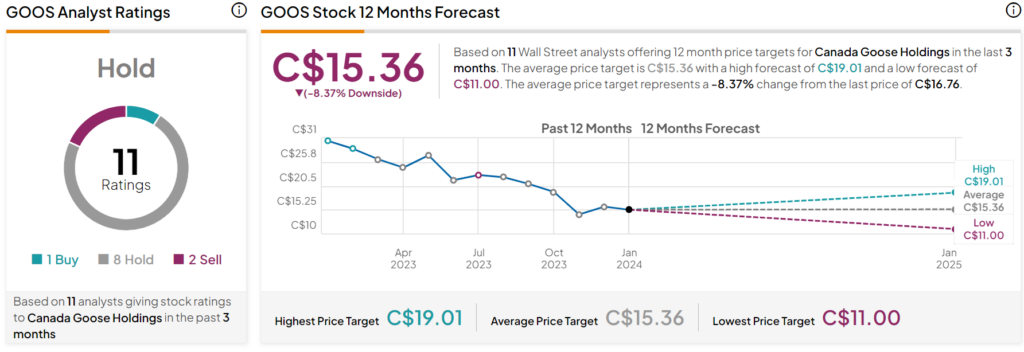

What Is the Price Target for GOOS Stock?

Overall, the Street has a Hold consensus rating on Canada Goose, and the average GOOS price target of C$15.36 points to an 8.4% potential downside in the stock. That’s on top of a 50% drop in the company’s share price over the past year.

Read full Disclosure