Nvidia (NASDAQ:NVDA) stock remains on a remarkable upward trajectory, surging 151% year-to-date. Even the recent announcement of a design issue delaying the Blackwell B200 chip’s volume shipments barely slowed the momentum.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Indeed, according to UBS’s Timothy Arcuri, an analyst ranked 4th among thousands of Wall Street stock pros, investors have little to worry about.

Arcuri’s checks indicate that the initial customer shipments of the Blackwell chip might be delayed by up to 4-6 weeks, potentially extending to late January 2025. However, the delay is expected to be partly offset as many customers turn to the H200 due to its shorter lead times. Leading customers are likely to have their first Blackwell units up and running around April 2025. Meanwhile, AI labs are “upsizing and lengthening” their instance commitments, while enterprises are rapidly increasing their share of demand, both of which are “bullish indicators.”

Given the 4-6 week delay from mid-December, Arcuri now anticipates only a minimal amount of Blackwell units will be sold in FQ4 (January quarter). However, his forecast for Hopper units is up by about 25%, thanks to shorter lead times and signs of increased capacity procurement in the supply chain.

As a result, Arcuri has lowered his FQ4 revenue estimate by about $500 million, aligning it more closely with general Street expectations. The delay also reduces his FQ1 revenue estimate by about $500 million, though his forecast still remains $3.5-4 billion above Wall Street estimates.

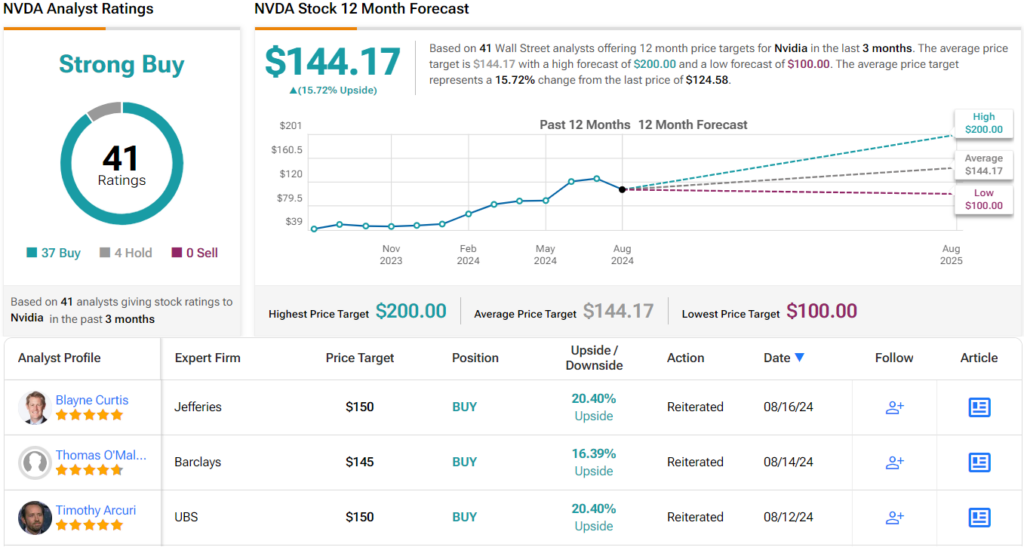

Despite these adjustments, Arcuri hasn’t changed his $150 price target for NVDA shares, suggesting a 20% upside over the next year. It’s no surprise that he rates the stock a Buy. (To watch Arcuri’s track record, click here)

Arcuri’s outlook is echoed by many of his colleagues. With 37 Buys outgunning 4 Holds, the consensus among analysts is that Nvidia is a Strong Buy. Going by the $144.17 average target, a year from now the shares will be changing hands for a ~16% premium. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.