With about a week remaining in the calendar year 2024, this year will go down as one of the best in recent memory for the S&P 500 Index (SPX), as the index has gained 24% so far this year. The investment bank and financial services company Morgan Stanley (MS) has fared even better, gaining more than 38% year to date. Is it still a buy heading into 2025, though? From my perspective, Morgan Stanley’s third-quarter results were robust. It is financially sound and also pays a dividend that can keep rising. However, the stock’s valuation looks excessive now, which could limit its upside. That’s why I’m initiating coverage with a Hold rating.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Morgan Stanley Delivered in Q3

Morgan Stanley’s third-quarter earnings report released on October 16, 2024, is one reason for my Hold rating. The company’s net revenue climbed 15.9% year-over-year to $15.38 billion, which was $1.03 billion above the analyst consensus. This topline growth was led by the Institutional Securities and Wealth Management segments, which each posted double-digit topline growth. That was due to greater client activity and momentum in Investment Banking in the former and net new assets of $64 billion in the latter. This helped total client assets under management reach $6 trillion. Morgan Stanley’s diluted EPS surged 36.2% to $1.88. For context, that was $0.29 more than the analyst consensus.

The Future Is Bright for Morgan Stanley

The dynamics also look favorable for Morgan Stanley in the years ahead, which is another element of my Hold rating. One potential tailwind for the company is that the environment for mergers and acquisitions is about to become easier. This is because the incoming Trump administration is expected to be more willing to work with companies on negotiating divestitures or other remedies as a condition to clear deals, according to the law firm Winston & Strawn. Along with interest rates that are coming down, the cost of capital for companies is becoming more manageable. These signs point to an uptick in M&A in 2025 and beyond. As one of the largest investment banks in the country, this bodes well for Morgan Stanley.

Another potential benefit down the line for the company is President-elect Trump’s plan to reduce the corporate tax rate from 21% to 15%. If passed by both chambers of Congress and signed into law, this would help Morgan Stanley in two ways. For one, it would be additional rocket fuel for assets under management in the Wealth Management and Investment Management segments. That’s because corporate profits would be boosted, which could further boost market fundamentals and sentiment, lifting equity markets in the process.

Additionally, at the corporate level, this would also buoy Morgan Stanley’s profits. For these reasons, the analyst consensus is that the company’s diluted EPS will rise by 8.8% to $8 in 2025. Another 10.7% jump in diluted EPS to $8.85 is expected in 2026. These growth rates would build on an anticipated 41.9% spike in diluted EPS to $7.35 in 2024.

Morgan Stanley’s Dividend Can Keep Growing and the Balance Sheet Is Solid

Morgan Stanley’s 3% dividend yield is more than double the financial sector average of 1.4%, which bolsters the case for my Hold rating. The payout ratio is slated to be in the high-40% range in 2024, which also makes the dividend rather secure. That’s because it provides a buffer for Morgan Stanley to endure a temporary downturn in profits and still maintain the dividend. This is why I’d expect high-single-digit annual growth in the years ahead. In my view, that’s a nice mix of immediate income and income growth potential.

Financially, Morgan Stanley’s strong balance sheet is another reason for my Hold rating. As of September 30, 2024, the company’s Common Equity Tier 1 (CET1) ratio was 15.1%. That’s about in line with the 15.2% CET1 ratio at the end of 2023. For perspective, this is comfortably above the regulatory minimum of 13.5% for the company set forth by the Federal Reserve Board, effective October 1, 2024. That explains how Morgan Stanley enjoys an A- credit rating from S&P Global (SPGI).

MS Stock Could be Overvalued

The only factor holding me back from a Buy rating for Morgan Stanley is its valuation. Shares are trading at a forward P/E ratio of 15.6x, which is above its 10-year average P/E ratio of 13.5x. The company’s 10% annual forward diluted EPS growth outlook is about in line with its 10-year average in the low double-digit range. As a result, I believe that fair value remains right around a 13.5x multiple. That would imply shares are worth approximately $110 each, which is a moderate premium from current levels.

Is Morgan Stanley Stock a Buy, According to Analysts?

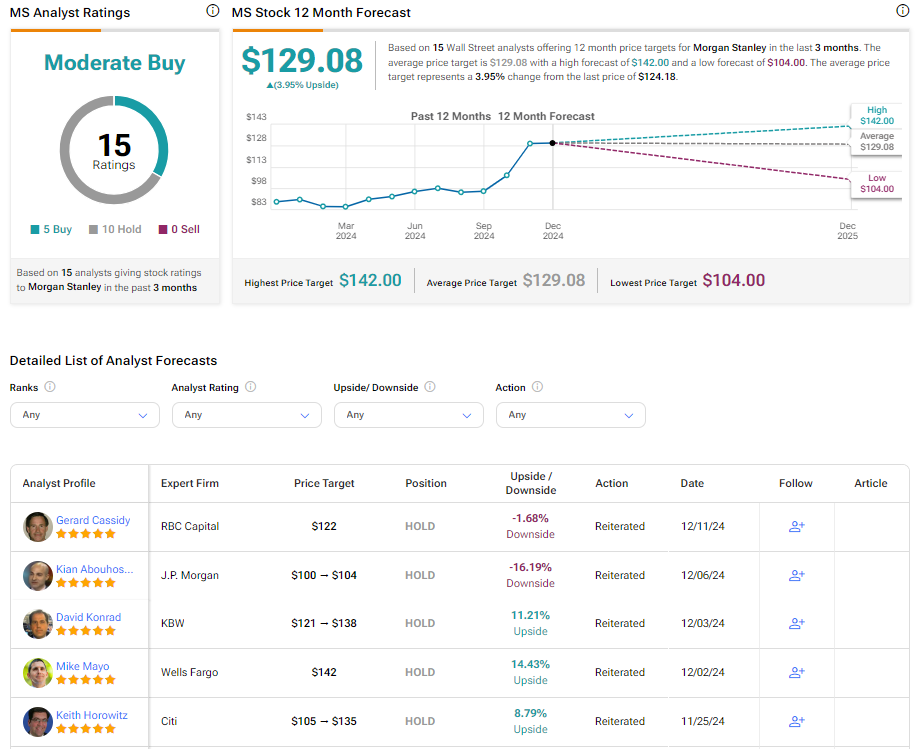

Turning to Wall Street, analysts have a Moderate Buy consensus rating on Morgan Stanley. Out of 15 analysts, five have issued Buy ratings, and the remaining 10 have assigned Hold ratings in the last three months. The average 12-month price target of $129.08 implies a 3.95% upside from the current levels.

Conclusion

Morgan Stanley is a financial with respectable growth ahead. The company’s dividend looks to be sustainable and the balance sheet is well-positioned. Unfortunately, the valuation has gotten ahead of itself. That’s why I believe the upside in the coming months could be limited and consequently, I’m starting coverage with a Hold rating.