MicroStrategy (NASDAQ:MSTR) continues its climb, fueled by CEO Michael Saylor’s unyielding Bitcoin obsession. With a mission to hoard as much BTC as possible, the company’s high-stakes gamble is shaping up to be a rewarding one.

Since kicking off its buying spree in August 2020, the shares have obliterated the overall market, gaining almost 3,200%, 547% of which have been generated this year.

So, it’s a bit of an understatement to say things have gone quite well for MSTR investors. With Bitcoin regularly hitting new highs, it’s not as if the stock needed another boost, but further good news arrived at the end of last week when Nasdaq announced that the stock would be added to the Nasdaq-100 Index (NDX).

This, says Benchmark analyst Mark Palmer, is a “major milestone.”

“The inclusion of MSTR in the Nasdaq-100 will give it exposure to billions of dollars in passive flows into the 13 exchange-traded funds (ETFs) that track the index, including the Invesco QQQ Trust (QQQ), which as of Friday had assets under management of $327.6bn,” Palmer, who ranks in the top 3% of Wall Street stock pros, went on to say. “The addition of the first bitcoin-focused company to the Nasdaq-100 will give indirect exposure to bitcoin to millions of investors.”

The Nasdaq-100 index comprises 100 of the biggest non-financial companies listed on the Nasdaq Stock Market. ETFs tracking the index buy significant amounts of shares during its annual rebalancing each December, with these purchases made without considering the share prices of the companies included in the index.

Getting added to the Nasdaq-100 offers a “near-term opportunity” but potentially being included in the S&P 500 would amount to an even bigger one over the medium-term. Although the company has no problem satisfying the S&P 500’s minimum requirements for market cap and trading volume, it currently falls short of meeting two key criteria: (1) positive earnings in the most recent quarter and (2) cumulative positive earnings over the past four consecutive quarters.

“However,” the 5-star analyst goes on to add, “MSTR has stated that it plans to adopt new Financial Accounting Standards Board (FASB) guidance for the accounting treatment of bitcoin held on corporate balance sheets in 1Q25, which would position it to immediately begin reporting positive earnings.”

If added to the S&P 500, MSTR would stand to gain from the inflows generated by passive funds that track the market’s benchmark index. This includes the SPDR S&P 500 ETF (SPY), which manages over $600 billion in assets.

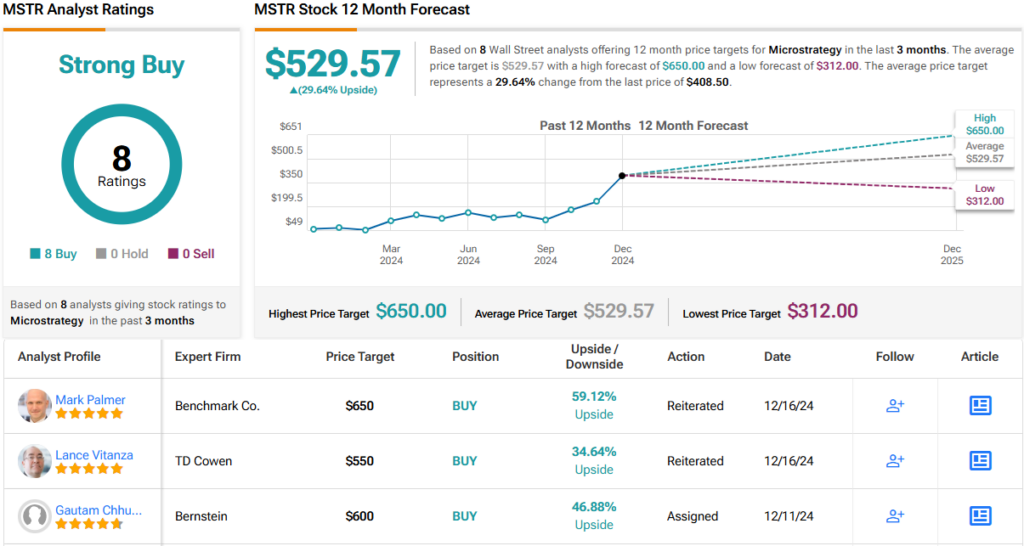

Bottom line, Palmer rates MSTR shares a Buy along with a Street-high $650 price target. The implication for investors? Potential upside of 59% from current levels. (To watch Palmer’s track record, click here)

All 7 other recent analyst reviews on MSTR are also positive, naturally making the consensus view here a Strong Buy. Going by the $529.57 average price target, a year from now, shares will be changing hands for a ~30% premium. (See MSTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.