Abercrombie & Fitch (NYSE:ANF) stock is up 371.7% over 12 months. It’s not the first company we’d think of when it comes to exponential share price gain. After all, it’s in clothing and accessories, not AI. The stock has outperformed all major indexes and its peers in the apparel segment. However, it’s starting to look like Abercrombie’s momentum is running out, with the company registering its smallest sales beat in six quarters in March.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

While selling too early can be one of the biggest mistakes we make as investors, the case for buying Abercrombie shares appears to be fading a little. Therefore, I am neutral on the stock.

Still Beating Expectations

Abercrombie & Fitch stock pulled back on March 6 following a strong set of quarterly results that failed to meet very high investor expectations. The company’s fourth-quarter performance surpassed the consensus estimate of analysts, with net income coming in at $158.4 million. Meanwhile, ANF’s gross margin improved significantly by 720 basis points to 62.9%.

Moreover, quarterly sales grew by 21.1% to $1.453 billion. However, this was the smallest sales beat in six quarters and raised concerns that the company’s remarkable growth was slowing.

Abercrombie’s success over the past 18 months can be traced to its rebrand. The company has refocused on customer demands in a changing environment, even removing the Abercrombie logo from most of its clothing. Moving away from its preppy, exclusive, and cool-kid brand image, the company has put more focus on increasing the quality of its products.

It has also scrapped its previously limited sizing offerings in favor of more inclusive styles and sizes. And it’s interesting to note that Abercrombie, and not its subsidiary Hollister, is driving the business forward. In its March quarterly earnings, it was noted that Abercrombie-branded store sales surged by 34.8% to $755.2 million, while Hollister sales increased by 9.1% to $697.7 million.

Not Stagnating

Share price momentum has slowed, and so has earnings growth. However, that’s not to say that Abercrombie can’t continue its rise. The company has re-established and rebuilt a brand that was floundering into one that is well suited to the current social and economic climate.

Moreover, management is looking to build upon this success through its move into the lucrative wedding sector and the opening of new stores, including one on London’s Oxford Street. It’s a little less pretentious than its previous flagship on Savile Row.

Likewise, we can probably expect a tailwind in the form of falling interest rates over the next 24 months as credit becomes cheaper and mortgage repayments fall, which will perhaps impact millennial clients more than Gen Z. Nonetheless, the resumption of student loans in October 2023 does represent something of a downside risk.

Valuation Does Stand Out

A quick comparison with Abercrombie’s peers suggests that the company is trading near a peak valuation. At least, that’s the case unless Abercrombie continues to beat expectations. Currently, Abercrombie is trading at 15.8x forward earnings, and this is expected to fall to 15.1x in year two and 14.3x in year three.

This makes it more expensive than Urban Outfitters (NYSE:URBN) and American Eagle (NYSE:AEO). Urban Outfitters trades at 11.9x forward earnings, then 10.9x in year two, and 10.3x in year three. Finally, American Eagle trades at 14.3x forward earnings, 12.9x in year two, and 10.7x in year three. Abercrombie clearly doesn’t stand out here.

Moreover, with earnings expected to grow around 10% per annum over the medium term, we can observe a forward price-to-earnings-to-growth (PEG) ratio of around 1.4. That’s not particularly appealing, given that fair value tends to be indicated by a ratio of one. This ratio can be skewed when stocks offer a dividend. However, Abercrombie & Fitch currently doesn’t pay one.

Is Abercrombie & Fitch Stock a Buy, According to Analysts

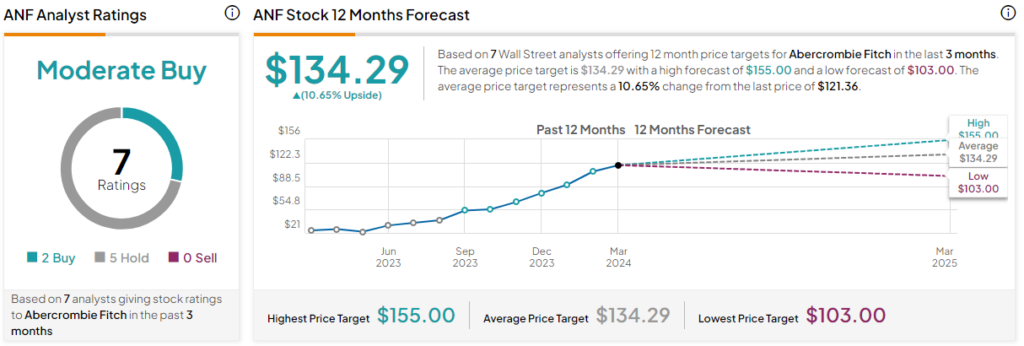

Abercrombie & Fitch has a Moderate Buy rating, according to analysts who have covered the stock in the last three months. There are two Buys, five Holds, and zero Sell ratings. The average ANF stock price target is $134.29, inferring 10.65% upside potential from the current share price. The highest share price target is $155, and the lowest is $103.

The Bottom Line

Abercrombie & Fitch shares have been one of the top investing stories of the last 12 months. However, the stock appears to be running short on momentum despite the recent earnings beat. Clearly, investors were expecting more from this stock, given the company’s impressive track record of the preceding 18 months.

While the brand turnaround has been impressive, and several tailwinds are still working in the company’s favor, Abercrombie is now starting to look a little expensive. The company’s forward price-to-earnings ratios suggest the stock is more expensive than its peers, while its PEG ratio infers that growth expectations are more than priced in.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue