Camping World Holdings CEO, Marcus Lemonis, said that he remains “very excited” about the company’s prospects in FY21 and projects its adjusted EBITDA to be in the range of $640 million to $690 million, up 13% to 22% year-over-year.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Camping World (CWH) also announced that its board of directors has approved a cash dividend of $0.23 per share on its Class A common Stock. The recreational vehicle and parts seller stated that the newly declared dividend will be payable on Mar. 29 to shareholders of record date as of Mar. 15.

Camping World said that the cash dividend includes a regular quarterly cash dividend of $0.09 per share which will be funded by unit cash distribution by CWGS Enterprises, LLC. Another $0.14 per share will be distributed as a special quarterly dividend which represents a portion of excess tax distributions from CWGS Enterprises.

CWGS Enterprises is a wholly-owned subsidiary of Camping World which owns and operates multi-store dealerships of new and used recreational vehicles and outdoor accessories. It distributes both, regular and special dividends, for Camping World stockholders. (See Camping World stock analysis on TipRanks).

Camping World on Feb. 25 reported better-than-expected 4Q results. The company’s non-GAAP EPS of $0.48 surpassed analysts’ expectations of $0.22 while revenues of $1.13 billion topped Street estimates of $1.08 million.

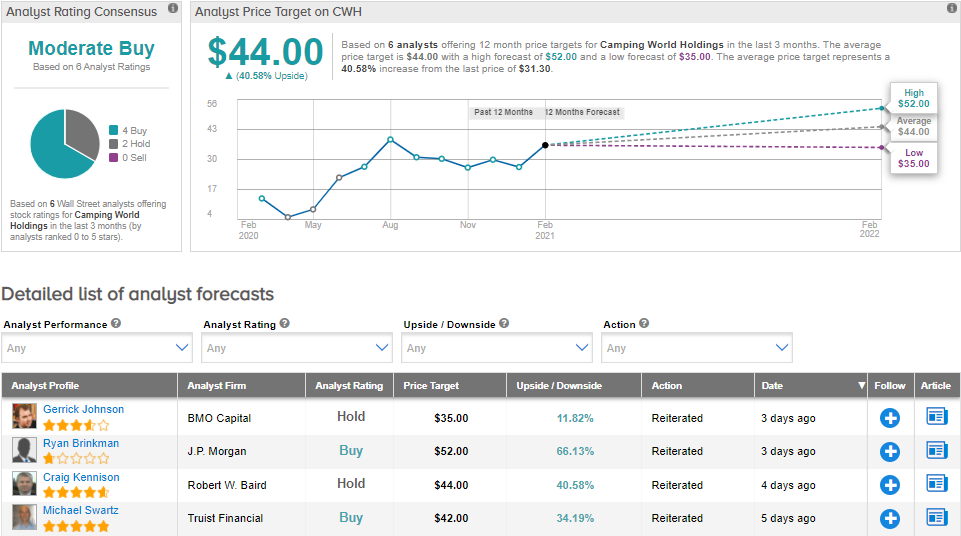

On Feb. 26, J.P. Morgan analyst Ryan Brinkman raised the stock’s price target to $52 (66.1% upside potential) from $45 and reiterated a Buy rating. Brinkman remains impressed with the company’s strong financial performance in the last three consecutive quarters.

Overall, the consensus among analysts is a Moderate Buy based on 4 Buy ratings and 2 Hold ratings. The average analyst price target of $44 implies upside potential of about 40.6% to current levels. Shares have surged 125% over the past year.

Related News:

Logitech Lifts FY21 & Long-Term Outlook; Street Sees 10% Upside

Twilio In Talks To Invest Up To $750M In Syniverse – Report

Service Properties Disappoints With 4Q Revenues, FFO Loss