Campbell Soup posted better-than-expected earnings and revenues in its fiscal 4Q, as consumers piled up on its products amid the COVID-19 pandemic. Meanwhile, shares are currently down about 1.9% in morning market trading after the food and beverage maker said that sales are expected to fall in second half of fiscal 2021 as lockdown restrictions ease.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

“Moving on to the second half of fiscal 2021 we will be lapping the significant pantry load and one-time effect that COVID-19 had on our business in the second half of fiscal 2020,” said Campbell’s CFO Mick Beekhuizen. “We do expect net sales to decline given the significant one-time nature of last year’s growth.”

“In the back half of fiscal 2021, as we lap this past year’s COVID-19-related costs, we expect to have opportunity, although we expect those gains are not likely to fully offset the impact from volume declines,” he added.

In the quarter ended Aug. 2, Campbell Soup’s (CPB) net sales increased 18% to $2.11 billion year-over-year, exceeding analysts’ expectations of $2.06 billion. Campbell’s Prego pasta sauces and Goldfish crackers were among the products, which boosted sales, the company said. Adjusted EPS of $0.63 per share rose 26% year-over-year, surpassing the Street consensus of $0.60 per share.

Campbell forecasts fiscal 1Q net sales to rise between 5% and 7% and adjusted EPS to be between $0.88 and $0.92 per share. This compares with analysts expectations for EPS of $0.90 per share and for net sales to rise 5.2% (See CPB stock analysis on TipRanks).

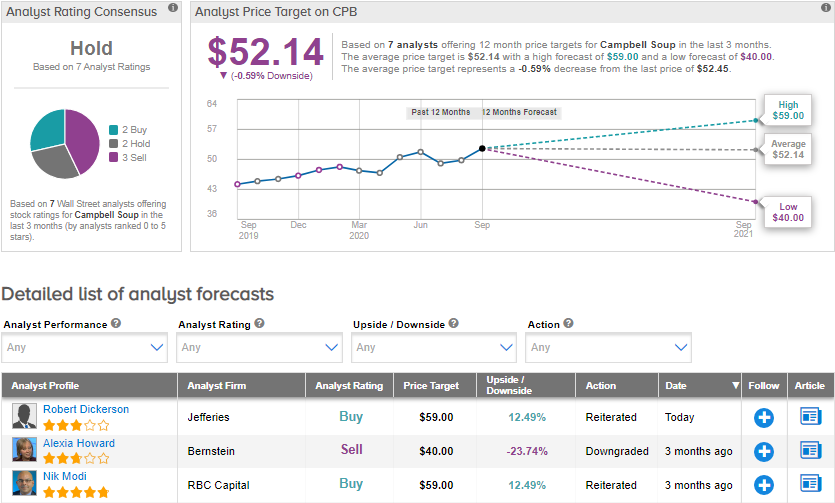

Just ahead of its 4Q results, Jefferies analyst Robert Dickerson maintained a Buy rating on the stock with a price target of $59 (12.5% upside potential). Dickerson said that “With retail takeaway trends still elevated through the summer months combined with operating leverage, positive margin mix, and LNCE [Snyder’s-Lance] synergy tailwinds, we continue to find the shares attractive at current valuation.”

Meanwhile, the Street is sidelined on the stock. The Hold analyst consensus is based on 2 Holds, 2 Buys and 3 Sells. The average price target of $52.14 implies that shares are more than fully priced at current levels. Shares are up by 6.1% year-to-date.

Related News:

Five Spikes 7% In After-Hours As 2Q Sales Top Estimates

Ambarella Drops 3% In Pre-Market On Dim 3Q Sales Outlook

Copart Gains 4% in After-Hours On Quarterly Sales Win