Caltech (California Institute of Technology) has made peace with Apple (NASDAQ:AAPL) and Broadcom (NASDAQ:AVGO) and reached a resolution regarding a patent infringement lawsuit. Caltech has permanently dismissed the billion-dollar case, eliminating any chance of it being refiled.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Caltech filed a lawsuit against Apple and Broadcom in 2016. It accused these companies of patent violations related to Wi-Fi chips manufactured by Broadcom and employed in Apple’s products. Subsequently, both companies were ordered to pay Caltech $1.1 billion as compensation for patent infringement.

While the settlement terms remain confidential, the U.S. Supreme Court rejected an appeal made by Apple and Broadcom to review their arguments earlier in June 2023. Consequently, these companies were obligated to pay fines for patent infringement. Apple was directed to provide $837 million in damages, while Broadcom was asked to pay $270 million.

Investors should note that Apple and Broadcom continue to face several patent claims relating to their products. Unfavorable resolutions to these claims may lead to financial liabilities, necessitate corporate adjustments, and cause reputational damage.

As these companies have reached a resolution with Caltech, let’s look at what the Street recommends for their shares.

Is Apple a Buy, Sell, or Hold Today?

Given the near-term pressure on hardware sales, Wall Street analysts are cautiously optimistic about Apple stock. Notably, Barclays analyst Tim Long expects Apple’s hardware sales to fall short of the consensus estimate in the fourth quarter. The analyst blamed a slower recovery in China and supply-chain headwinds for the shortfall.

Overall, with 20 Buy and nine Sell recommendations, AAPL stock has a Moderate Buy consensus rating. Further, Apple stock has gained about 40% year-to-date. Meanwhile, analysts’ average price target of $207.69 suggests a further upside potential of 14.93% from current levels.

What is the Prediction for Broadcom Stock?

Analysts are upbeat about Broadcom stock, as AI (Artificial Intelligence) presents significant growth opportunities for the company. Broadcom has developed a platform that accelerates the development and deployment of AI clusters. This would boost its top line and drive its stock price.

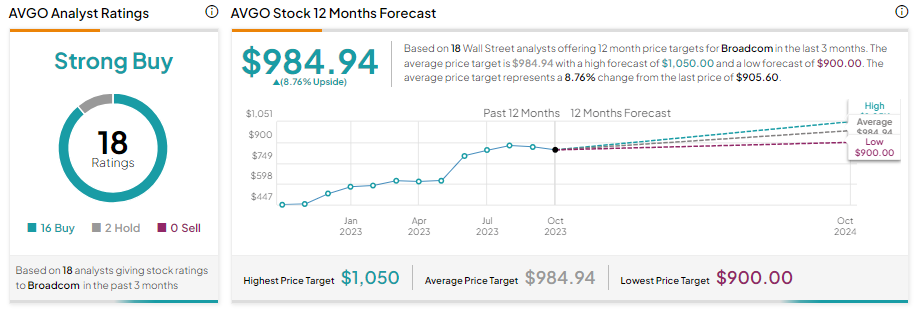

With 16 Buy and two Hold recommendations, Broadcom stock has a Strong Buy consensus rating. AVGO stock has gained nearly 65% year-to-date, which is why analysts’ average price target of $984.94 implies a limited upside potential of 8.76% from current levels.