Shares of Cardinal Health (CAH) were on an upswing in pre-market trading on Wednesday after the healthcare services company raised its forecast for FY25 and announced robust Fiscal Q4 results. The company raised its FY25 outlook and now expects adjusted earnings to be in the range of $7.55 to $7.70 per share, compared to its prior forecast of $7.50 per share.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

This is higher than analysts’ expectations of $7.53 per share. Furthermore, Cardinal Health raised its guidance for the growth in profits of its Pharmaceutical and Specialty Solutions to be in the range of 1% to 3%, up from at least 1%. Cardinal’s Pharmaceutical and Specialty Solutions unit distributes branded and generic drugs, specialty medicines, and over-the-counter products.

Cardinal Health Reports Robust Fiscal Q4 Results

In the fourth quarter, the company’s adjusted earnings surged by 29% year-over-year to $1.84 per share, surpassing consensus estimates of $1.73 per share. Cardinal generated Q4 revenues of $59.9 billion, up by 12% year-over-year, beating analysts’ expectations of $58.6 billion.

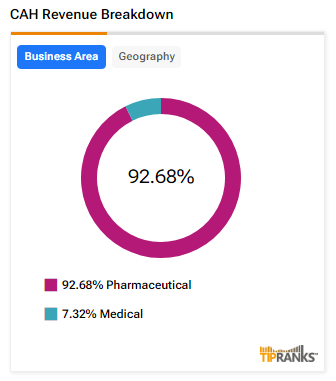

The healthcare company’s Pharmaceutical and Specialty Solutions posted revenues of $55.6 billion, up by 13% year-over-year and comprised more than 90% of its revenues in the fourth quarter.

CAH’s Plans Increased Stock Buybacks

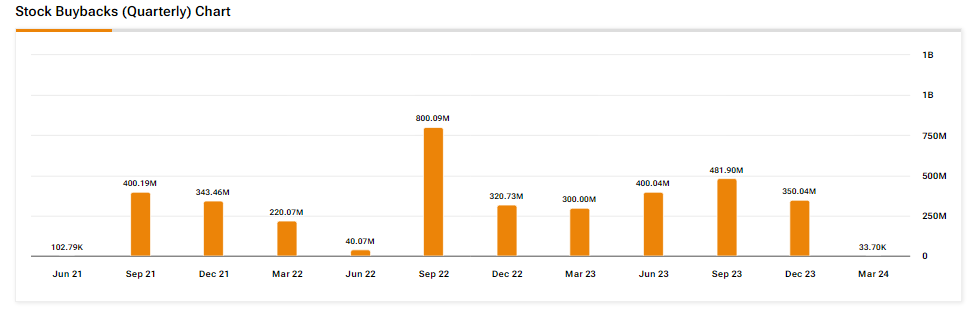

In FY25, the company plans to buyback stock worth $750 million, an increase of $250 million. The company raised its outlook for stock buybacks as it is targeting at least $500 million in near-term value from its Global Medical Products and Distribution (GMPD) Solutions business through working capital improvements. The resulting cash from these measures will be strategically deployed according to its disciplined capital allocation framework resulting in higher share repurchase activity.

In the nine months ending on March 31, 2024, Cardinal bought back stock worth $750 million.

Is CAH a Good Stock to Buy?

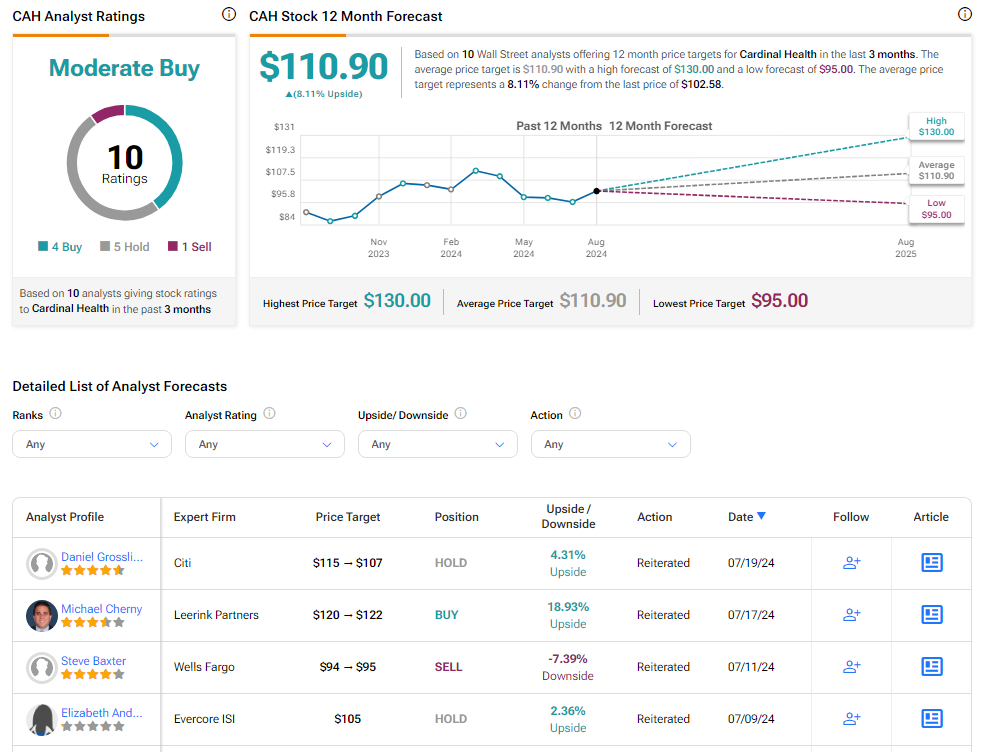

Analysts remain cautiously optimistic about CAH stock, with a Moderate Buy consensus rating based on four Buys, five Holds, and one Sell. Over the past year, CAH has increased by more than 10%, and the average CAH price target of $110.90 implies an upside potential of 8.1% from current levels. These analyst ratings are likely to change following CAH’s results today.