CAE’s fiscal third-quarter earnings missed analysts’ expectations impacted by the pandemic-led halt of the travel industry as well as restructuring costs and lower adjusted segment operating margin. Shares of the Canadian technology company, which has the world’s largest civil aviation training network, including full-flight simulators, closed 1.2% lower on Feb. 12.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

CAE’s (CAE) fiscal 3Q adjusted earnings decreased 41% on a year-over-year basis to C$0.22 per share, missing Street estimates of C$0.25 per share. Total revenue fell 10% to C$832.4 million but surpassed the consensus mark of C$611.18 million.

The company’s restructuring costs came in at C$14.3 million, compared with no such costs in the prior-year quarter. The adjusted segment operating margin was 11.7% in the quarter, down from 17.7% year over year.

CAE CEO Marc Parent commented, “The pandemic continues to be a global reality and the resumption of CAE’s recovery remains highly dependent on the timing and rate at which travel restrictions and quarantines can eventually be safely lifted and normal activities resume in our end markets. Looking beyond, given our recent investments and future potential opportunities to deploy growth capital, we are confident CAE will emerge from this period in a position of even greater strength.”

For the fiscal year 2021, the company expects positive free cash flow and total capital expenditures of around C$100 million. (See CAE stock analysis on TipRanks)

On Dec. 17, Merrill Lynch analyst Ronald Epstein upgraded the stock to Buy from Hold and increased the price target to C$43 from C$30. The analyst expects the company to benefit from the recovery in commercial traffic.

Epstein believes demand for pilots and crew training will recover with a rise in traffic volumes. The analyst argues that CAE’s flexible training options will become more popular for “financially challenged” airline customers.

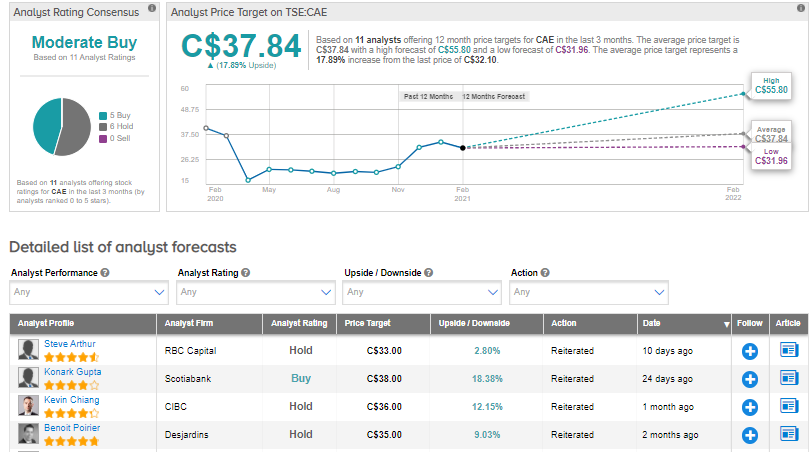

The rest of the Street is cautiously optimistic about the stock. The Moderate Buy consensus rating breaks down into 5 Buy ratings and 6 Hold ratings. The average analyst price target stands at C$37.84 and implies upside potential of about 17.9% to current levels over the next 12 months. Shares jumped 46.3% over the past six months.

Related News:

Lincoln Electric Posts Better-Than-Expected Quarterly Profit; Street Sees 5% Upside

Chemours Quarterly Earnings Outperform; Shares Gain 3.3%

Coca-Cola Posts Better-Than-Expected Quarterly Profit; Street Sees 14% Upside