The all-stock merger of equals involving Cabot Oil & Gas Corporation (COG) and Cimarex Energy Co. (XEC) has been approved by the shareholders of both companies. The deal, which was announced in May 2021, is expected to close on October 1, 2021.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

As per the terms of the deal, shareholders of Cimarex will receive 4.0146 shares of Cabot common stock for each share held. Also, after the completion of the deal, the combined business plans to change its name and ticker symbol. (See Cabot stock charts on TipRanks)

The merger will create a diversified energy leader with the combination of two industry-leading operators having top-tier oil and natural gas assets. Notably, the combined company will be headquartered in Houston. (See Cimarex stock charts on TipRanks)

The Chairman, President and CEO of Cimarex, Thomas E. Jorden, said, “Our combined business will have top-tier assets that will generate substantial cash flow to drive peer-leading returns through commodity price cycles. We look forward to completing this transaction and delivering these compelling benefits to our shareholders.”

On September 28, Citigroup analyst Kevin Cunane reiterated a Buy rating on Cabot and raised the price target to $25 from $21. The new price target implies 10.9% upside potential from current level.

Cunane is of the opinion that with rising natural gas prices, cash flows in the exploration and production group are likely to beat consensus estimates in the quarters ahead.

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 4 Buys, 1 Hold and 1 Sell. The average Cabot price target of $24 implies 6.4% upside potential.

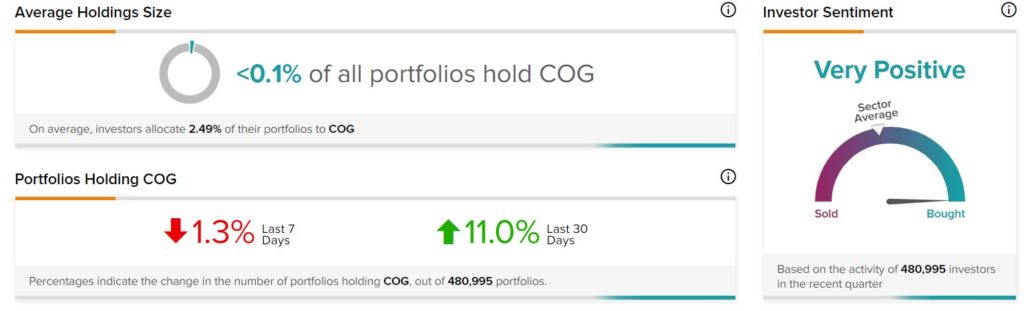

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Cabot with 11% of investors on TipRanks increasing their exposure to COG stock over the past 30 days.

Related News:

American Tower Prices €1B Senior Notes Offering

Navient Announces Plan to Exit Federal Student Loan Servicing Contract

Casey’s to Buy 40 Pilot Convenience Stores for $220M