We all know the history of the late 90s tech bubble, when enthusiasm for the then-new digital economy inflated the dot.com companies to an extraordinary level – and then the bubble burst. The explosion of AI onto today’s tech scene brings that earlier bubble to mind.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

But there are differences in today’s situation, significant differences that suggest today’s enthusiasm for AI tech is a more enduring phenomenon. To start with, demand for AI is proving consistent across the tech world, and for another, the changes that AI is ushering in are almost certain to be longer-lasting.

In a recent commentary, Wedbush analyst Daniel Ives, a well-known tech expert, emphasized these differences, stating, “We have covered tech on the Street since the late 90’s and this is NOT a bubble but instead the start of a 4th Industrial Revolution now on the doorstep that will have major growth ramifications for the tech sector led by the software/use case phase in motion… In our opinion taking a step back this is just the top of the first inning of a $1 trillion + AI market opportunity coming to the shores of the tech sector over the next few years led by the enterprise market and followed by the consumer use cases (Apple, Meta, Google, Amazon) set to be deployed over the coming years.”

Unsurprisingly, Ives has taken these thoughts to their logical conclusion, making specific recommendations. In Ives’ view, C3.ai (NYSE:AI) and Palantir (NYSE:PLTR) are among the best AI stocks to buy right now. Here’s a closer look at the details.

C3.ai

We’ll start with C3.ai, a software firm that has built itself as a leader in enterprise-scale AI applications. The company’s product line includes a wide range of AI-powered software and tools, available through its AI Applications, AI Application Platform, and AI Development Tools. C3.ai’s software is used across numerous economic sectors, from customer engagement to fraud detection to predictive maintenance to supply chain optimization. The company markets its AI products to customers large and small, including major names like the oilfield services firm Baker Hughes, the utility company ConEdison, and even the US Army and Air Force.

C3.ai isn’t just an industry leader in enterprise AI, it is also known as an innovator, and a mover in the ongoing digital transformation of the global economy. The company provides its AI apps and software with a combination of efficiency and cost benefits that bring value while supporting user operations, a sound combination for any tech provider. C3.ai’s customers realize benefits in improved engagement with their own customers, cleaner monetary pathways, and smoother supply chains. In short, C3.ai has put itself at the center of the changes that AI technology is bringing to the world, and to the ways we work in it.

Shares in C3.ai have been volatile this year, ranging from a high of $37 to a low of $20. However, the stock received a significant boost after the release of its fiscal 4Q24 financial results on May 29.

The surge came after C3.ai beat the expectations on both the fiscal Q4 results and the guidance for fiscal 2025. The company reported a top line for the quarter of $86.6 million, beating the forecast by $2.2 million and growing almost 20% year-over-year. The bottom line came to a net loss of 11 cents per share, by non-GAAP measures. While negative, this EPS beat the estimates by 19 cents per share.

Looking ahead, the company provided revenue guidance for fiscal year 2025 that was well above the consensus. Management predicts a top line in the range of $370 million to $395 million for fiscal 2025, compared to the $367.53 million that had been expected.

Checking in with Wedbush’s Daniel Ives, we find that he’s upbeat on C3.ai’s performance, and on the company’s prospects to keep growing.

“C3 delivered its FY4Q24 (April) results featuring top and bottom-line beats while expanding its market share across a myriad of industries pointing to its increasing market share in this early stage of the AI Revolution… The company also noted that in FY4Q24, C3 witnessed 50k inquiries for its Generative AI solutions across 15 different industries as the company continues to deepen into new verticals and improve its diversification across industries. This was a step in the right direction,” Ives opined.

Ives goes on to give the stock an Outperform (i.e. Buy) rating, accompanied by a $40 price target that shows his confidence in a 28% upside on the 12-month horizon. (To watch Ives’ track record, click here)

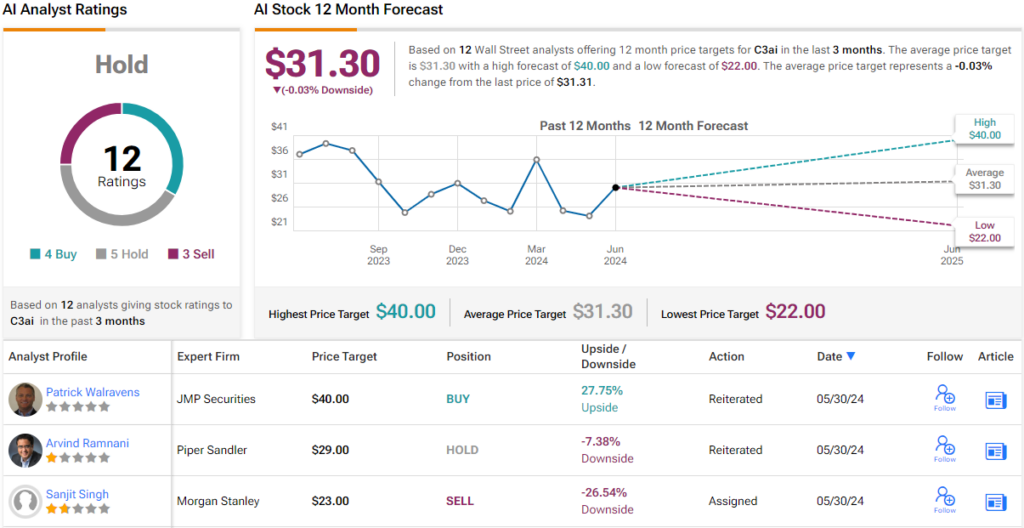

While Ives is bullish, the overall view on Wall Street is less so. The stock has 12 recent analyst reviews on file, that break down to 4 Buys, 5 Holds, and 3 Sells, for a Hold consensus rating. The analysts anticipate shares to stay range-bound for the foreseeable future, as the $31.30 average price target indicates. (See AI stock forecast)

Palantir

Next up is Palantir, a tech firm founded by billionaire and prolific venture capitalist Peter Thiel. Palantir was founded in 2003 to use cutting-edge data analytics technology to provide usable insights. The firm was named after the magical seeing-stones from Tolkien’s Lord of the Rings; the stones are ‘those which look far way,’ and that sums up Palantir’s mission. The company’s advanced data analytics and AI software allow its customers to view the underlying patterns of events in real time.

AI lies at the center of all it does, but Palantir does not ignore or leave out the human factor. The company sees AI tech as a way of augmenting human intelligence, not replacing it, and works to combine both to reap the unique benefits that each can offer. Palantir’s subscribers have access to a range of AI platforms, including the flagship AIP (AI platform), designed on that premise, using natural language processing to allow complex interactions with human users. The company’s products and tools can understand complex user questions, and give detailed, nuanced answers in response, a capability based on the model of human interaction. The systems are designed to avoid using complex computing codes and scripts, and to avoid programming languages and statistical models; Palantir’s goal is to make high-end data analysis easily accessible to the non-expert.

AI and data analysis are becoming ever more invaluable across a wide range of sectors, and for a wide variety of customers. Palantir’s services are in high demand, particularly in the Department of Defense. On May 30, the company announced it had received a $153 million initial contract with the Department of Defense, with additional awards possible up to $480 million over the next 5 years.

This contract win made a nice cherry on top of Palantir’s last quarterly earnings report, released early in May for 1Q24. The company reported its top line at $634 million, for a year-over-year gain of nearly 21%. This was over $16 million better than had been anticipated. The bottom line, an 8 cents per share non-GAAP EPS, was in line with expectations. By GAAP measures, Palantir’s Q1 was its sixth profitable quarter in a row. The solid financial results came on top of a strong gain in the customer count; Palantir grew its customer base by 42% year-over-year.

Daniel Ives is impressed by this AI company, particularly its growing capacity for growth. He writes of Palantir, “We continue to see increased momentum in the PLTR growth story with AIP leading the charge in generating significant demand across both commercial and government landscapes while well-positioned to gain a larger share of this $1 trillion opportunity taking place with AI use cases exploding globally.”

Seeing a market like that ahead of Palantir, it’s no wonder that Ives rates the stock as Outperform (i.e. Buy). He sets his price target at $35, implying an upside of ~47% over the next 12 months.

Once again, we’re looking at a stock with a Street consensus significantly less optimistic than the Wedbush view. The Hold consensus here is based on 12 analyst reviews, with only 2 Buys overbalanced by 7 Holds and 3 Sells. The shares are priced at $23.85, and their $22.11 average target price suggests a 7% downside from that level. (See PLTR stock forecast)

To find good ideas for AI stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.