Hong Kong-listed BYD Co. Limited (HK:1211) is again leading China’s NEV market in September, capturing around 34.4% of the market share. Although BYD’s market share declined from 37.0% in August, it continued to be the only company with a share of over 30% of China’s NEV market. Year-to-date, BYD shares have gained 30% in trading.

Based in China, BYD Co. is one of the top global manufacturers of EVs (electric vehicles) and power batteries.

BYD Sets New Sales Milestones as Growth Soars

According to the China Passenger Car Association (CPCA), BYD sold a record 419,426 NEVs (new energy vehicles) in September, marking a 45.91% year-on-year increase. The company’s sales in September marked its fourth consecutive month of record growth, mainly driven by solid sales of its hybrid models.

In international markets, BYD sold 33,012 vehicles, representing a 17.74% increase compared to the previous year and a 4.96% rise from August.

The Battle for EV Supremacy Heats up in 2024

Among its competitors, the American giant Tesla (TSLA) slipped one spot to fourth place in September. However, Tesla’s share in China’s NEV market went up to 6.4% from 6.2% in August, showcasing the brand’s growing popularity. In September, Tesla’s retail sales in China reached 72,200 vehicles, marking a 66% year-over-year increase.

Moreover, Tesla is still topping the charts in pure electric sales. The company delivered 462,890 EVs in Q3, edging out BYD’s 443,000 sales to retain the top spot. Additionally, Tesla is ahead of BYD in the 2024 race, delivering 1,293,656 vehicles in the first nine months, outpacing BYD’s 1,169,579 EV sales.

According to a Counterpoint Research report, BYD is poised to surpass Tesla in BEV sales this year, with its market share projected to soar. Meanwhile, Tesla topped the global EV market share in 2023.

Moving ahead, the race remains unpredictable and highlights the ever-evolving global EV landscape, and Tesla may need to broaden its EV lineup to stay ahead.

Is BYD a Good Stock to Buy Now?

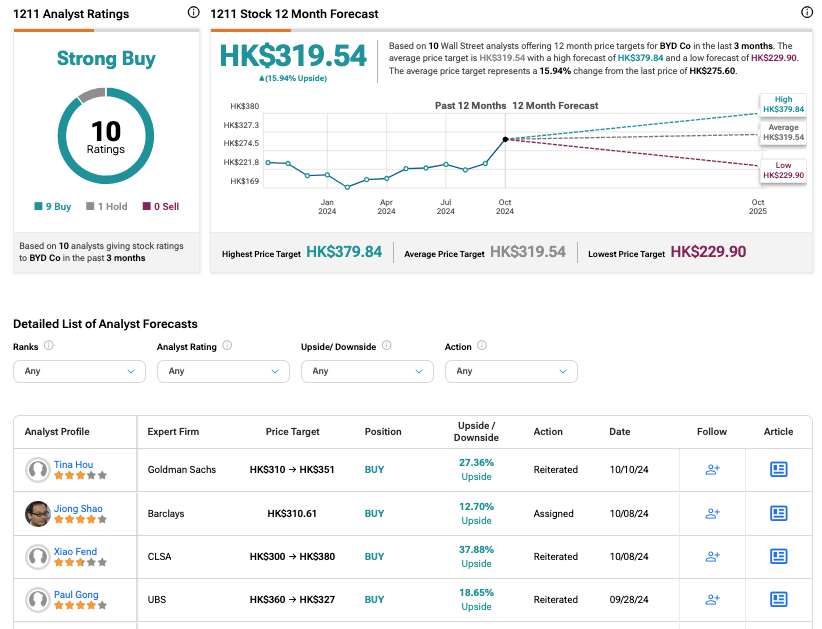

Analysts maintain a highly bullish stance on BYD stock. Following the release of BYD’s September numbers, the stock earned Buy recommendations from Goldman Sachs, Barclays, and CLSA.

According to TipRanks, 1211 stock has received a Strong Buy rating, backed by nine Buys and one Hold recommendation. The BYD Co. share price target is HK$319.54, which implies an upside of 16% from the current trading level.