Blackstone (NYSE:BX) announced strong first quarter results on Thursday. The alternative investment management company reported distributable earnings of $0.98 per share, which were up by 1% year-over-year and above consensus estimates of $0.97 per share.

In Q1, Blackstone generated total revenues of $3.69 billion, compared to $1.38 billion in the same quarter last year, exceeding consensus estimates of $2.57 billion. By the end of the first quarter, the company had total assets under management (AUM) of $1,061.3 billion.

In addition, the company declared a quarterly dividend of $0.83 per share to record holders of common stock at the close of business on April 29. This dividend will be paid on May 6, 2024.

Is BX a Good Stock to Buy?

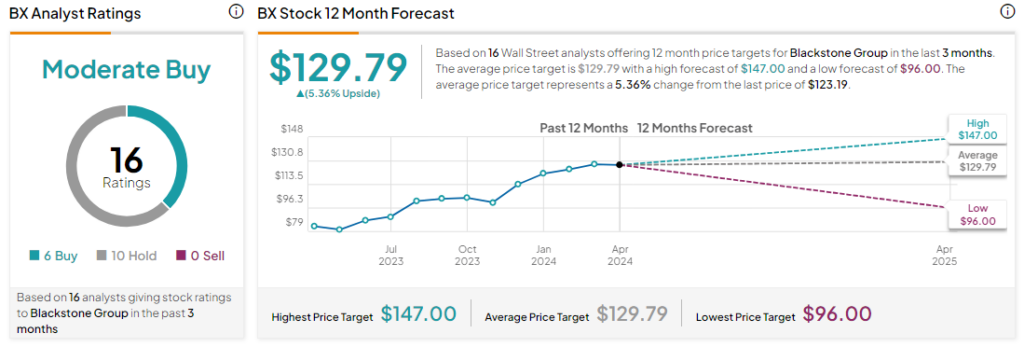

Analysts remain cautiously optimistic about BX stock, with a Moderate Buy consensus rating based on six Buys and 10 Holds. Over the past year, BX has increased by more than 35%, and the average BX price target of $129.79 implies an upside potential of 5.4% from current levels.