Shares of American digital media company, BuzzFeed, Inc. (BZFD) have crashed 28.6% in just 2 days of its listing on the Nasdaq stock exchange on December 6.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

BuzzFeed is the very first digital media company to go public. The company produces online content spanning articles, quizzes, videos, etc. across a series of genres including politics, music, food, animals, and culture, to name a few. Its shares dipped 8.3% to close at $7.85 on December 7.

SPAC Merger

BuzzFeed became a public company via a merger with a special purpose acquisition company (SPAC), 890 5th Avenue Partners Inc, on December 3, valuing the company at a whopping $1.5 billion.

For a long time, companies in the digital media space like Vice, Vox, etc. have been vying to go public, but BuzzFeed has been the first one to successfully come up with an IPO. However, investors pulled out before the merger, as is the case with many SPAC deals.

Originally, BuzzFeed was slated to raise more than $250 million from the SPAC deal, but ended up with just $16 million as redemptions occurred.

BuzzFeed has disclosed its intent to snap up competitors from the industry, where scale plays an important role in capturing market share. The company also completed the acquisition of Complex Networks, a sports and entertainment publisher, for $300 million.

Labor Unrest

Employees of BuzzFeedNews Union are not particularly happy with BuzzFeed’s listing, since the two have been at loggerheads for a mutually agreeable contract since 2019. Several workers walked out of the office last Thursday protesting the company’s delay in accepting their requests.

The union is fighting on grounds of salary hikes, permission to do freelance work and publish content on other media channels, and to evaluate employees’ work based on article traffic. The latest round of negotiations is to be held today and both parties hope they reach a consensus that is mutually beneficial to them.

See Analysts’ Top Stocks on TipRanks >>

Latest Financials

BuzzFeed’s third-quarter revenue grew 20% year-over-year to $90.1 million, aided by a 39% jump in advertising revenue to $50.24 million. The company also posted a quarterly loss of $3.58 million, up 68% compared to the same period last year.

According to the filing, Complex Networks (acquisition pending) posted a 9% year-over-year revenue growth to $31.2 million in Q3. The company reported a loss of $3.1 million.

Management Comments

On the occasion of listing, BuzzFeed Founder and CEO, Jonah Peretti, said, “Today I’m grateful to everyone who helped make BuzzFeed the destination for the best things on the internet: the video creators, the writers, the award-winning journalists, the internet visionaries — and the most socially engaged, diverse audience the world has ever seen.”

Peretti added, “Our next chapter as a public company will help BuzzFeed, Inc. become a hub for even more brands and creators, visionary founders and CEOs, high-quality content for the tech platforms, and so much more.”

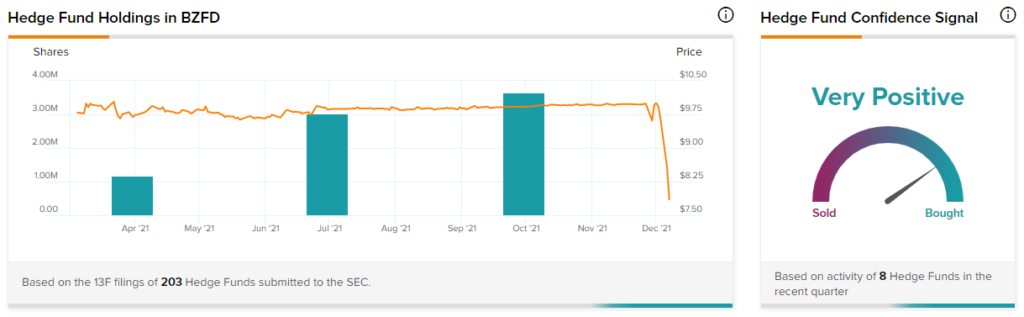

Hedge Fund Activity

According to TipRanks’ Hedge Fund Trading Activity tool, confidence in BZFD stock is currently Very Positive, as 8 hedge funds have increased their cumulative holdings of the stock by 627,300 shares in the last quarter.

Related News:

AutoZone Surges 7.6% on Solid Q1 Beat

Coupa Software Down 10.7% Despite Outstanding Q3 Beat

SEC Probes Tesla Over Solar Panel Defects Case