Building materials manufacturer and supplier Builders FirstSource, Inc. (NYSE: BLDR) recently revealed that its board has authorized the repurchase of $1 billion of its common shares.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Following the news, shares of the company popped 3.9% on Friday. However, the stock pared its gains by 1% to close at $71 in the extended trading session.

Details of the Plan

The timing and amount of any share repurchases under the share repurchase program will be made at the discretion of the company, taking into account its capital needs, share price, and overall market conditions. The purchases under the program may be made through a variety of methods, which may include open market purchases and block trades, among others.

Notably, the company, under its previous share repurchase programs in August and November of 2021 had repurchased a total of 30.6 million shares of common stock at an aggregate cost of $2 billion or an average price of $65.43 per share. As of February 17, 2022, the company had shares outstanding of roughly 176.8 million shares.

Management Commentary

The CEO of Builders FirstSource, Dave Flitman, said, “The completion of our prior share repurchase plans and our new repurchase authorization announced today are a direct reflection of the financial strength of our company, our ability to deploy our robust free cash flow to drive profitable growth and our commitment to shareholder value creation.”

Stock Rating

Consensus among analysts is a Strong Buy based on 9 unanimous Buys. The average Builders FirstSource price target of $102.33 implies upside potential of 42.7% from current levels. Shares have gained 73.3% over the past year.

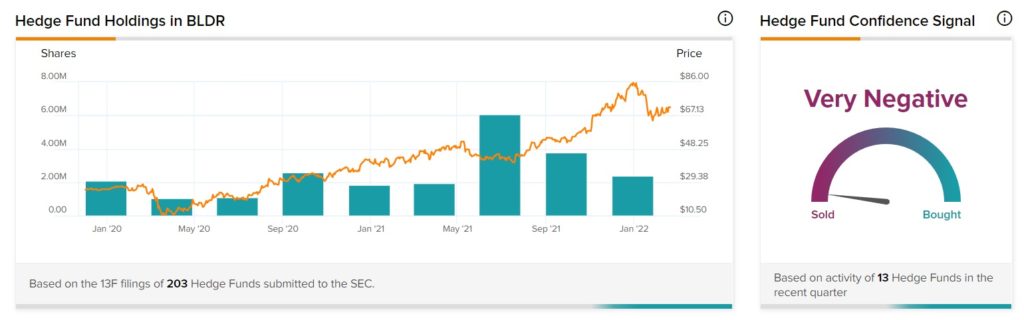

Hedge Funds’ Confidence

TipRanks’ Hedge Fund Trading Activity tool shows that hedge fund confidence in Builders FirstSource is currently Negative. Moreover, the cumulative change in holdings across the 13 hedge funds that were active in the last quarter was a decrease of 1.4 million shares.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Foot Locker Partners with Authentic Brands to Offer Reebok Products in the U.S.

Universal Music Signs Deal to Develop NFT Collections

Palantir Tanks 16% on Q4 Earnings Miss; Revenues Outperform