Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) released its Q1 financials, which marked a significant drop in earnings. What caught attention was that Berkshire trimmed its holdings in iPhone maker Apple (NASDAQ:AAPL) stock for the second time. Moreover, the firm sold its entire stake in media and entertainment company Paramount Global (NASDAQ:PARA).

While the sale of stocks by Buffet’s Berkshire might be seen as a negative indicator, it’s crucial for investors to consider multiple parameters when making investment decisions. This is where tools like TipRanks’ Experts Center can be invaluable, providing a comprehensive view for informed investment decisions.

With this in mind, let’s check what the future holds for these stocks.

Is Apple a Buy, Hold, or Sell?

Berkshire’s Apple holdings stood at $135.4 billion at the end of Q1, down from $174.3 billion in Q4 of 2023. This is the second quarter in a row that Berkshire has trimmed its stake in AAPL stock. Nonetheless, Buffett praised Apple during the annual meeting and added that Apple may continue to be Berkshire’s largest investment in 2024.

Further, Buffett hinted at tax implications for selling Apple stock, as current capital gains tax rates are lower compared to historical levels. He suggested that these rates might increase in the future due to policy changes.

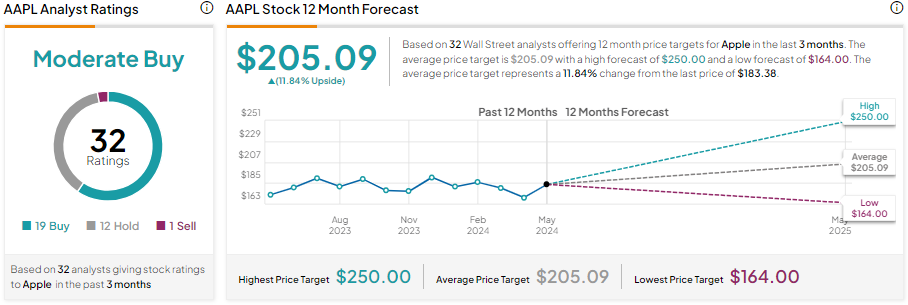

It’s worth noting that Apple stock is down about 5% year-to-date, reflecting softness in demand, increased competition in China, and legal headwinds. Nevertheless, its better-than-expected Q2 performance and massive $110 billion buyback plan could act as catalysts. With 19 Buy, 12 Hold, and one Sell recommendation, AAPL stock has a Moderate Buy consensus rating. The analysts’ average AAPL stock price target is $205.09, which implies 11.84% upside potential from current levels.

What Is the Projection for Paramount Stock?

Berkshire sold its entire stake in paramount stock at a loss. It’s worth noting that Paramount stock has declined over 23% in one year, eroding shareholders’ value. Sony Pictures Entertainment, a subsidiary of Sony (NYSE:SONY), and an asset management firm, Apollo Global Management (NYSE:APO), made a $26 billion all-cash bid to acquire the company.

Meanwhile, Wall Street is sidelined on PARA stock. It has received six Buy, eight Hold, and seven Sell recommendations for a Hold consensus rating. Analysts’ average PARA stock price target of $13.29 implies 3.10% upside potential from current levels.