Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) added new positions in U.S. homebuilders D.R. Horton (NYSE:DHI), Lennar (NYSE:LEN) and NVR (NYSE:NVR) in the second quarter. The news of Buffett gaining exposure to these homebuilder companies moved DHI, LEN, and NVR shares higher by 3%, 2.1%, and 1.7%, respectively, in Monday’s extended trading session.

Berkshire Builds Positions in Homebuilders

As per Berkshire’s latest 13-F filing with the Securities and Exchange Commission (SEC), Berkshire owned 5.97 million DHI shares worth $726 million, 152,572 LEN shares worth $17.2 million, and 11,112 NVR shares that had a value of $70.6 million as of the end of June 2023.

A dearth of existing homes for sale and robust demand have caused a surge in the construction of new homes, triggering a rally in homebuilders’ stocks. Shares of D.R. Horton, Lennar, and NVR have risen 38%, 37%, and 34%, respectively, year-to-date.

Investors are likely to pay attention to Buffett’s interest in these stocks, given that Berkshire operates one of the leading residential real estate brokerage businesses. Wall Street analysts have a Moderate Buy consensus rating on DHI and LEN, while they are sidelined on NVR.

Berkshire – A Net Seller of Stocks in Q2 2023

Berkshire purchased about $4.6 billion of stocks in Q2 2023, up from nearly $2.9 billion worth of stocks bought in the first quarter. However, the firm was a net seller of stocks in the second quarter, selling shares worth $12.6 billion. Berkshire ended Q2 2023 with $147.4 billion in cash and cash equivalents.

While Berkshire increased its positions in Occidental Petroleum (NYSE:OXY) and Capital One Financial (NYSE:COF), it trimmed its stake in Chevron (NYSE:CVX), Activision Blizzard (NASDAQ:ATVI), Celanese (NYSE:CE), General Motors (NYSE:GM) and Globe Life (NYSE:GL).

Additionally, Berkshire exited its investments in healthcare group McKesson (NYSE:MCK), insurer Marsh & McLennan (NYSE:MMC), and Vitesse Energy (NYSE:VTS).

The market value of Berkshire’s equity portfolio based on the latest 13-F filing was $348.2 billion as of the end of Q2 2023, up 7% compared to $325.1 billion as of the end of the first quarter.

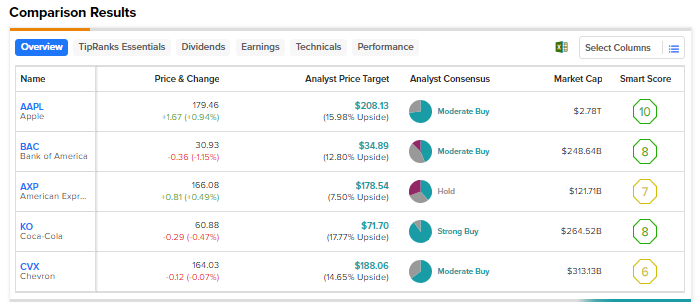

As of Q2-end, Apple (NASDAQ:AAPL), Bank of America (NYSE:BAC), American Express (NYSE:AXP), Coca-Cola (NYSE:KO), and Chevron were the top five holdings and accounted for 80% of Berkshire’s overall stock portfolio.

Using TipRanks’ Stock Comparison Tool, let’s have a look at Wall Street’s ratings for Berkshire’s top five holdings.

TipRanks’ proprietary technology scans the SEC submissions of all major hedge funds, and presents the data to everyday investors in an easy-to-read format. Check out TipRanks’ Expert Center tools to track the moves of hedge funds, corporate insiders, and other experts.