Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) has increased its stake in Bank of America (BAC) with a purchase of over 34 million shares in the last few days.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Berkshire Hathaway purchased the stock at $24 per share, taking its stake in the banking giant from 7.4% to over 11%. Shares in Bank of America have plunged nearly 32% since the beginning of the year.

Buffett has mostly held off from making risky investments since the outset of the pandemic. At the end of March, the company retained $137 billion in cash. By May, the company had sold $6 billion in stocks in April, making it a net seller of equities.

Berkshire Hathaway said in a May 2 regulatory filing, “As efforts to contain the spread of the COVID-19 pandemic accelerated in the second half of March and continued through April, most of our businesses were negatively affected, with the effects to date ranging from relatively minor to severe.”

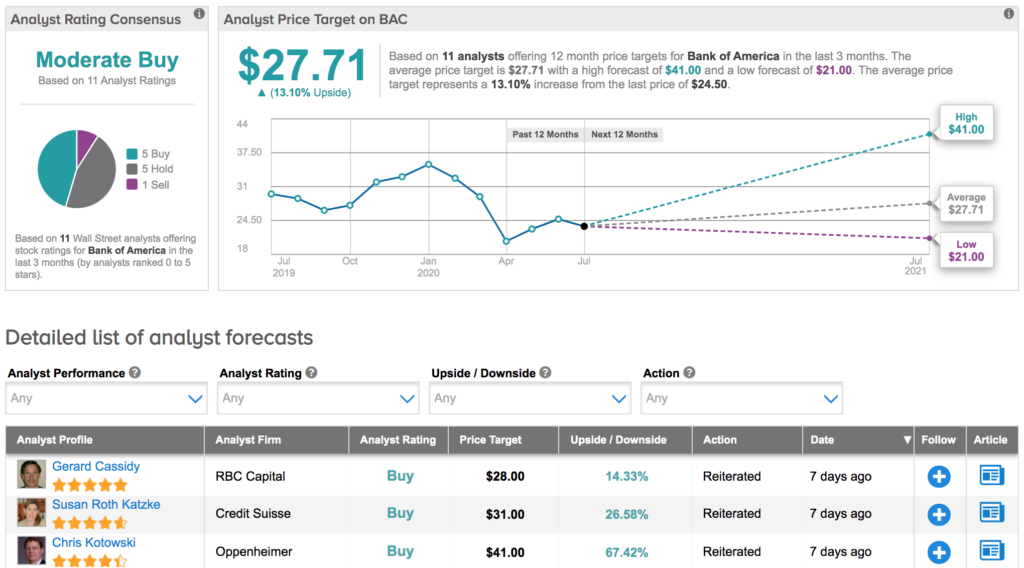

D.A. Davidson analyst David Konrad believes BAC has the strongest balance sheet and the lowest risk profile among its banking peers. However, he warns that as other banks build their reserves, Bank of America’s “lower risk advantage” will decrease. The analyst downgraded his Bank of America Buy rating on July 9 to a Hold rating. He also reduced his price target from $27 to $25, which implies 3% upside potential.

KBW analyst Brian Kleinhanzl also commented on current banking risks, saying, “The bank stocks now must climb over investors’ wall of worry that is building on lower rates for a potential longer economic recovery.” He added that there is “an uncertain dividend outlook and a presidential election year that could bring unfavorable changes for bank regulation and higher taxes.” He maintains a Hold rating on BAC’s stock as of July 6.

Overall, 5 analysts assign Buy ratings, 5 Hold ratings, and 1 Sell rating, giving BAC a Moderate Buy Street consensus. The average analyst price target stands at $27.71, suggesting 13% upside potential, with shares already down 31% year-to-date. (See Bank of America stock analysis on TipRanks).

Related News:

Two Harbors Ends Management Agreement, Citing Material Breaches

J.P. Morgan: 2 High-Yield (5%-Plus) Dividend Stocks to Buy Now

Goldman Sachs Says Buy These 2 Stocks for 30%-Plus Upside