Shares of Bombardier Recreational Products Inc. (DOO) jumped 9% in early trading Thursday, after the company reported increased revenues and profits in the second quarter of its Fiscal Year 2022.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The manufacturer of motorsports vehicles, snowmobiles, and boats raised once again its forecast for the current fiscal year. (See BRP stock charts on TipRanks)

Revenue for Q2 2022 came in at C$1.9 billion, a year-over-year increase of 54%. The company attributed the increase primarily to a higher wholesale of year-round and seasonal products, due to the impact of COVID-19 last year.

Net income was C$213 million (C$2.46 per diluted share) in the quarter ended July 31, compared to C$126.1 million (C$1.43 per diluted share) in the prior-year quarter.

On a normalized basis, diluted EPS rose 154% to C$2.89, from C$1.14. Analysts expected quarterly earnings of C$1.72 billion, and normalized earnings of C$1.39 per share.

“Looking ahead, we are optimistic about the future considering continued strong demand for our products, our new and exciting product introductions and additional capacity coming online over the next few months,” said BRP president and CEO José Boisjoli. “Based on this positive outlook and factoring in ongoing supply chain and logistics challenges we are increasing our overall guidance for Fiscal ’22.

“Normalized EPS is now expected to grow between 53% and 81% over last year. Furthermore, we are well-positioned to build on this momentum and generate further growth in Fiscal 23 primarily driven by sustained consumer interest in powersports and the upcoming significant inventory replenishment cycle.”

The company also expects revenue growth in the range of 27% and 35% from FY 2021.

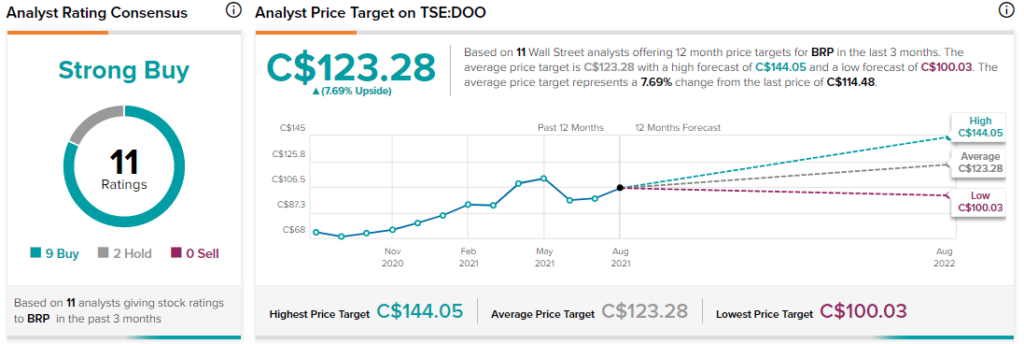

Last week, TD Securities analyst Brian Morrison reiterated a Buy rating on the stock with a price target of C$120. This implies 3.9% upside potential.

The rest of the Street is bullish on BRP, with a Strong Buy consensus rating, based on nine Buys and two Holds. The average BRP price target of C$123.38 implies 7.7% upside potential to current levels.

Related News:

ATS Acquires NCC Automated Systems for $40M

Boyd Group Services Q2 Sales Rise 44%

Heroux-Devtek Swings a Profit in Q1