Shares of BRP Inc (DOO) fell more than 2% in early trading Thursday despite the company swinging to a profit in the first quarter of 2022. As a result of strong earnings, the manufacturer of motorsports vehicles, snowmobiles, and boats increased its FY 2022 guidance.

BRP President and CEO José Boisjoli said, “We had an exceptional start of the year, building on our momentum of growth from prior quarters. Our first quarter results were driven by ongoing robust demand for our products with North American Powersports retail up 39%. We were also lapping a quarter in which our manufacturing operations were partly shutdown.”

Revenue for Q1 2022 came in at C$1.81 billion, an increase of 47% versus the prior-year quarter. The company attributed the increase primarily to higher wholesale in year-round and seasonal products due to the effects of last year’s pandemic, as well as lower sales programs due to a strong retail environment.

Meanwhile, net income was C$244.4 million (C$2.79 per share) in the quarter ended April 30, compared to a loss of C$226.1 million (-C$2.58) in the prior-year quarter. On a normalized basis, EPS rose 873% to C$2.53 from C$0.26.

Due to a solid first-quarter performance, José Boisjoli reported that the annual outlook for Fiscal 2022 has been raised.

“Following our solid first quarter performance, positive outlook for the business and factoring in current supply chain constraints, we increased our overall guidance for Fiscal 22 with Normalized EPS now expected to grow between 44% to 58% over last year,” he said.

As for revenues, the company now expects growth in the range of 27% to 33% from FY 2021. (See BRP Inc stock analysis on TipRanks)

About a month ago, Citigroup analyst Shawn Collins initiated coverage on DOO with a Buy rating and a C$136.00 price target (39% upside potential).

Collins wrote in a research note that the company’s valuation metrics “sit squarely in line with the larger leisure universe” and don’t reflect a premium for BRP’s “best-in-class execution”. For this reason, the analyst thinks the stock provides an opportunity.

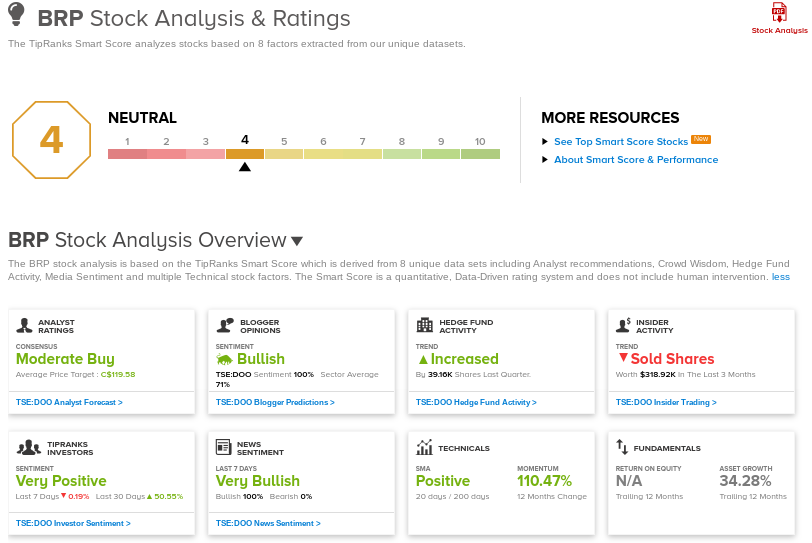

The rest of the Street is cautiously optimistic on DOO with a Moderate Buy consensus rating based on 5 Buys and 3 Holds. The average analyst price target of C$119.58 implies 23% upside potential to current levels. Shares have gained approximately 80% over the past year.

TipRanks’ Smart Score

DOO scores a 4 out of 10 on TipRanks’ Smart Score rating system, suggesting that the stock is likely to perform in line with the overall market.

Related News:

Pembina Pipeline Offers to Buy Rival Inter Pipeline for C$8.3B; Shares Down 3%

Heroux-Devtek Q4 Sales Decline 7%; Shares Jump 8%

Bombardier’s Railway Sale Boosts 1Q Profit