On Monday, Evercore ISI analyst Matthew Prisco initiated coverage of Broadcom (NASDAQ:AVGO) stock, citing another decade of growth ahead, supported by artificial intelligence (AI)-led tailwinds. Prisco assigned a price target of $1,620, implying a 23.6% upside potential from current levels. The analyst’s price target is based on a P/E multiple of 23x (base case considering AVGO’s estimated 2027 earnings per share of $85).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Broadcom is a technology company offering semiconductor and infrastructure software solutions. In 2023, Broadcom acquired VMWare, an American cloud computing and virtualization technology company. Combined, their products serve many verticals, including cloud, data center, networking, software, broadband, wireless, storage, and industrial markets.

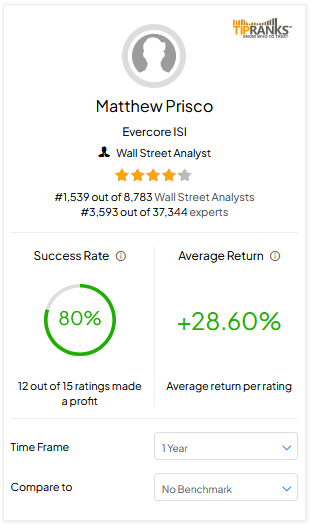

It is worth noting that Prisco is a 4-star analyst, with an 80% overall success rate. His ratings have delivered an average return of 28.6% over a one-year period. Interestingly, Prisco has a 100% success rate on AVGO stock.

Prisco’s Bullish Stance on Broadcom

Prisco believes that investors are underestimating the huge AI-led growth potential, which could last for at least another decade. Moreover, the analyst contends that investors are discounting the presence of other players in the AI market and focusing only on the major players such as Nvidia (NASDAQ:NVDA). These competing companies can disrupt 20%-30% of the market share and have the potential to earn massive returns.

As per Prisco, Broadcom owns a differentiated portfolio of high-speed data center switching, custom AI processor capabilities, and advanced integrated RF (radio frequency) solutions for the handset market. The company’s combined semiconductor offerings are well-positioned for the AI era, the analyst added. Finally, Prisco points to the value added by the company’s VMWare acquisition within the software portfolio.

For Fiscal 2024, AVGO expects revenue to grow 40% to $50 billion, while Prisco’s estimates are a bit higher at $52 billion.

Is Broadcom a Buy or Sell?

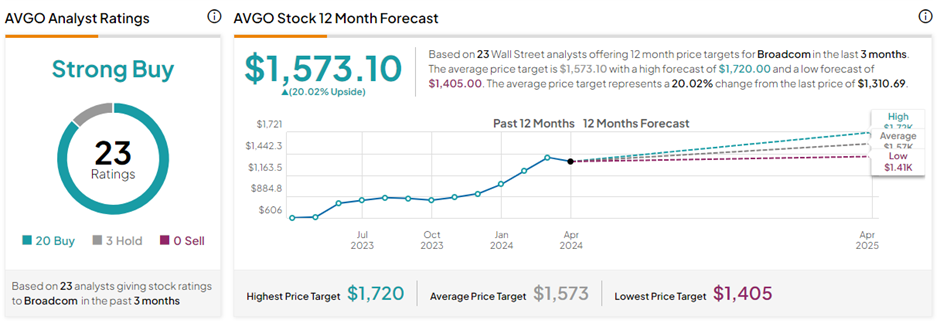

On TipRanks, AVGO stock commands a Strong Buy consensus rating based on 20 Buys versus three Hold ratings. The average Broadcom price target of $1,573.10 implies 20% upside potential from current levels.

AVGO also pays a regular quarterly dividend of $5.25 per share, reflecting an above-average yield of 1.47%.

Ending Thoughts

Broadcom is one of the attractive AI stocks, with sound financials, a robust portfolio, dividend-paying capability, and solid growth potential. Analyst Prisco is highly optimistic about the entire semiconductor segment and has initiated coverage of four stocks with a Buy. Investors considering exposure to the semiconductor space can consider AVGO stock after thorough research, for which Prisco’s highlights could be a starting point.