Broadcom (AVGO) reported better-than-expected fiscal Q2 results driven by strong demand for semiconductors across multiple end markets.

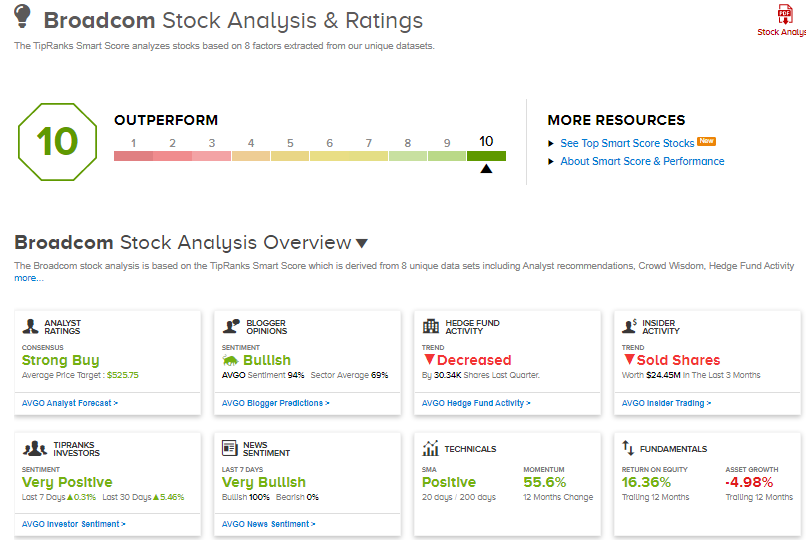

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Broadcom develops and supplies semiconductor and infrastructure software solutions.

The company reported revenues of $6.61 billion in Q2, which outpaced the Street’s estimates of $6.51 billion, and jumped 15% from the year-ago period.

Adjusted earnings came in at $6.62 per share, beating consensus estimates of $6.42 per share, and soared 28.8% year-over-year.

Broadcom CEO Hock Tan said, “Due to the strength in demand for semiconductors across our multiple end markets, we delivered 20% year-over-year increase in semiconductor revenue.”

Tan further added, “Our third quarter outlook projects this year-over-year growth to sustain, as we continue to see strong demand from service providers and hypercloud.” (See Broadcom stock analysis on TipRanks)

For fiscal Q3, the company expects revenues of $6.75 billion, which would represent year-over-year growth of 16%. The consensus estimate for the same is pegged at $6.59 billion.

Following the fiscal Q2 results, Mizuho Securities analyst Vijay Rakesh increased the stock’s price target to $520.00 from $490.00 for 11.9% upside potential and reiterated a Buy rating.

Rakesh commented, “We continue to see AVGO well positioned, with leadership in growing markets driven by secular trends 5G and data center, high margins, and strong FCF.”

Consensus among analysts is a Strong Buy based on 17 Buys and 3 Holds. The average analyst price target stands at $534.28 and implies upside potential of 15% to current levels. Shares have gained 50.5% over the past year.

Broadcom scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News :

Splunk Posts Wider-than-Feared Quarterly Loss, Revenues Beat Estimates

PVH Corp Posts Stronger-than-Expected Quarterly Results

Advance Auto Parts Delivers Strong Q1 Results as Profit Soars