Semiconductor company Broadcom (NASDAQ:AVGO) is scheduled to report its results for the first quarter of Fiscal 2024 after the market closes on March 7. Ahead of results, several analysts have expressed optimism about the company’s performance, fueled by solid demand for artificial intelligence (AI) chips. Moreover, AVGO’s impressive history of surpassing analysts’ estimates for 14 straight quarters, increases expectations of another beat.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

AVGO stock has soared nearly 117% in the past year and outperformed the 45% rise in the tech-heavy Nasdaq 100 Index (NDX).

AVGO – Q1 Expectations

Wall Street expects Broadcom to report sales of $11.8 billion in Q1, up about 32% year-over-year. The company’s top line is expected to show benefits from the VMware acquisition (completed in November 2023), positive momentum in the software business, and strong demand for its AI-related offerings.

Turning to earnings expectations, Wall Street analysts expect AVGO to post earnings of $10.40 a share in Q1, up about 1% year-over-year.

Analysts Weigh In

Among the analysts who are bullish on AVGO stock, Susquehanna’s Christopher Rolland believes the company’s AI networking push and VMware integration could support its financial performance.

Additionally, Rosenblatt Securities analyst Hans Mosesmann expects AVGO to beat estimates for the January quarter and issue an improved FY24 outlook. Also, Mosesmann raised his price target to $1,500 (11.7% upside) from $1,160.

What is the Forecast for AVGO Stock?

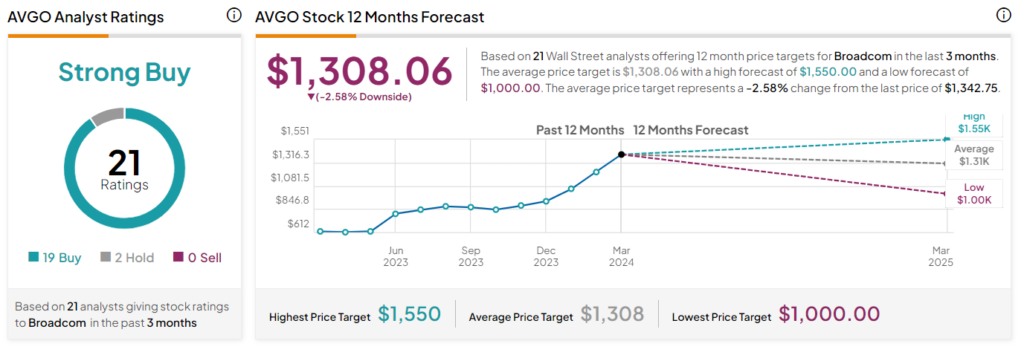

Wall Street’s Strong Buy consensus rating on Broadcom is based on 19 Buys and two Holds. Following the impressive rally of 55% over the past six months, the average price target of $1,308.06 suggests a downside of 2.6%.

Insights from Options Trading Activity

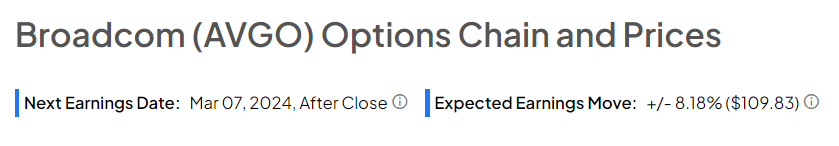

TipRanks presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a +/- 8.18% move on AVGO’s earnings, compared with the previous quarter’s earnings-related move of 2.39%.

The anticipated earnings move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Concluding Note

Analysts are bullish on Broadcom’s future based on its prospects in the booming AI market and the VMware acquisition. Both factors are expected to further fuel the company’s growth and profitability in the near term.