Broadcom, Inc. (AVGO), a designer, developer, and supplier of semiconductor and infrastructure software solutions, has reported upbeat results for the fourth quarter of Fiscal 2021 (ended October 31). A rebound in enterprise, cloud, and service provider demand acted as tailwinds.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Following the news, shares of the company surged 6.1% in the extended trading session on Thursday.

Quarterly Results in Detail

The company reported adjusted earnings of $7.81 per share, topping the consensus estimate of $7.41 per share. Broadcom reported adjusted earnings of $6.35 per share in the same quarter last year.

Net revenue of $7.4 billion grew 15% year-over-year and surpassed the Street’s estimate of $7.36 billion. Both Semiconductor solutions and Infrastructure software revenue drove the results.

Segment-wise, Semiconductor solutions revenue grew 17% year-over-year to $5.6 billion, while Infrastructure software revenue stood at $1.8 billion, up 8%.

Adjusted EBITDA for the quarter came in at $4.5 billion, up 18.4% year-over-year. As of October 31, 2021, cash and cash equivalents stood at $12.2 billion, compared to $11.1 billion at the end of the prior-year quarter.

Fiscal 2021 Results

For Fiscal 2021, the company reported adjusted earnings of $28.01 per share, up from $22.16 per share reported in the prior year. Net revenue came in at $27.5 billion, up 15% year-over-year.

Guidance

For the first quarter of Fiscal 2022, the company expects revenue of $7.6 billion, representing year-over-year growth of 14%. The consensus estimate stands at $7.25 billion. Adjusted EBITDA is expected to be 61.5% of projected revenue.

Capital Deployment

Broadcom’s Board of Directors has authorized a new share repurchase program of up to $10 billion of its common stock, effective until December 31, 2022.

Broadcom’s CFO Kirsten Spears said, “The initiation of a new share repurchase program reflects the confidence of the Board of Directors in Broadcom’s strong cash flow generation and provides us with a complementary tool to deliver value to our stockholders.”

Also, the Board has approved a quarterly cash dividend on the company’s common stock of $4.10 per share, up 14% from the prior payout. The new dividend will be paid on December 31, 2021, to shareholders of record as of December 22. Currently, Broadcom’s dividend yield stands at 2.44%.

See Insiders’ Hot Stocks on TipRanks >>

Wall Street’s Take

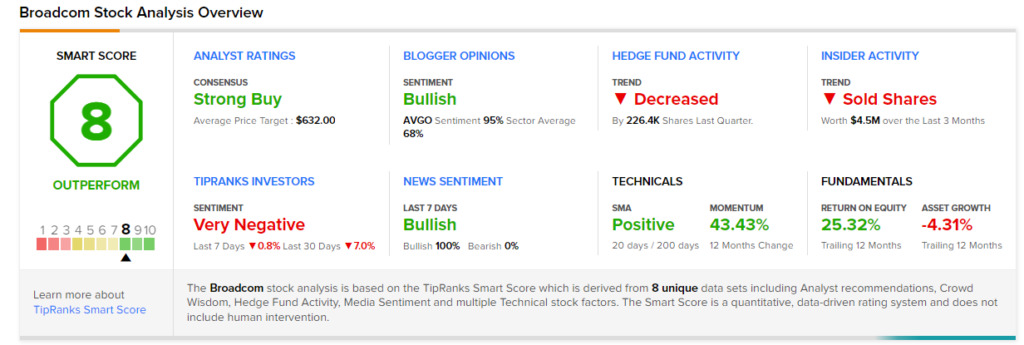

Consensus among analysts is a Strong Buy based on 11 unanimous Buys. The average Broadcom price target of $653.50 implies 12% upside potential. Shares have gained 42.3% over the past year.

Smart Score

Broadcom scores an 8 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

GameStop Posts Wider-than-Feared Q3 Loss; Shares Drop After-Hours

Pfizer & BioNTech Provide Results on Omicron Vaccine Efficacy

Tilray Acquires Breckenridge Distillery; Shares Gain