Updated on 5/26/2022

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

As reported by the Wall Street Journal, both Broadcom and VMWare’s boards have approved the massive deal, which is expected to complete during AVGO’s upcoming fiscal year.

VMWare has retained a 40-day grace period during which the firm may accept other offers of acquisition.

By 10am EST., VMWare’s stock was up over 1%, and Broadcom had gained over 2%.

Updated on 5/24/2022

Broadcom Inc. (NASDAQ: AVGO), a semiconductor technology company, is reportedly in talks to acquire cloud computing and virtualization technology company VMware, Inc. (NYSE: VMW), for $60 billion. The cash-and-stock deal worth around $140 per share is expected to be announced later this week.

According to media reports, Broadcom might opt for $40 billion debt to finance the deal.

Following the news related to the acquisition, Broadcom fell more than 3%, while VMware surged over 24% at Monday’s close.

Background

Broadcom is well-known in the chip industry for its continual investment in research and development, technical improvement, and diversifying revenue streams through strategic acquisitions.

In the current era of digitization, demand for cloud services is rising across all industries. Therefore, AVGO, with strong economies of scale and advanced technologies under its belt, is striving to establish itself in the corporate-software market.

The recent expected deal, if consummated, would keep the acquisition spree of the company alive, while also diversifying its business. With a focus on the software market in recent years, Broadcom purchased CA Technologies for about $18 billion in 2018 and Symantec Corp.’s enterprise security unit for $11 billion in 2019.

No comments were released by either of the companies.

Wall Street’s Take

Following the news of the expected deal, Mizuho Securities analyst Vijay Rakesh reiterated a Buy rating and a price target of $700 (32.99% upside potential) on the stock.

Rakesh commented, “VMWare would add Infrastructure Software exposure and a Multi-Cloud strategy enabled by a cloud-native application platform, infrastructure and secure edge & anywhere workspace bound by a common layer for management, security, and networking capabilities.”

According to the analyst, on the execution of the deal, AVGO could experience tripled software revenues from around $7 billion to more than $21 billion.

Shares of Broadcom have rallied 17.91% over the past year, while the stock still scores a Strong Buy consensus rating, based on 11 unanimous Buys. That’s alongside an average Broadcom price target of $710.91, which implies 35.06% upside potential to current levels.

Hedge Fund

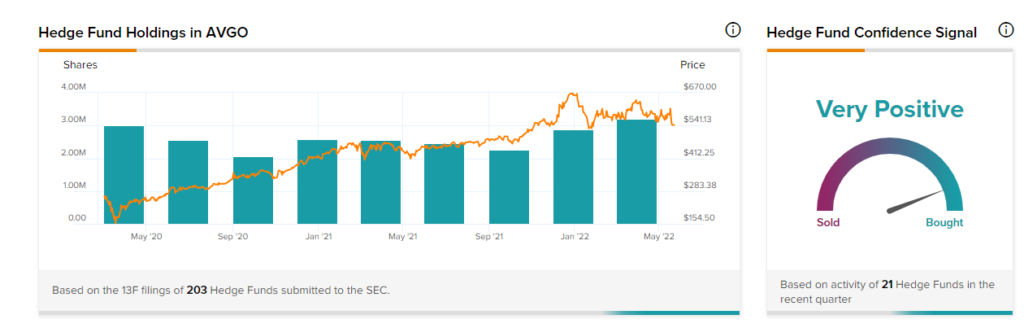

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Broadcom is currently Very Positive, as the cumulative change in holdings across all 21 hedge funds that were active in the last quarter was an increase of 301,800 shares.

Bottom-Line

Amid the recent market downturn, consolidation has become difficult in the market. This acquisition, if completed, might be the second-largest deal of 2022 after Microsoft Corp.’s (MSFT) buyout of videogame firm Activision Blizzard Inc. for $75 billion.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Related News:

ZIM Ships Encouraging Outlook on Record Quarterly Results

TJX Companies Records Strong Quarterly Revenues; Website Visits Hinted at it

Foot Locker Gains 6% Despite Mixed Q1 Results