Shares of Broadcom (AVGO) have surged roughly 118% year-to-date, outpacing the S&P 500’s (SPX) 27% increase, fueled by growing opportunities tied to artificial intelligence (AI). Building on this momentum, most analysts have maintained their Buy ratings on the stock, with several increasing their price targets. Notably, five-star analyst Joseph Moore of Morgan Stanley maintained an Overweight rating and raised his price target to $265, driven by enthusiasm for Broadcom’s custom AI chip prospects and strong chip design capabilities. In light of these developments, it’s the right time to delve into the ownership structure of AVGO.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

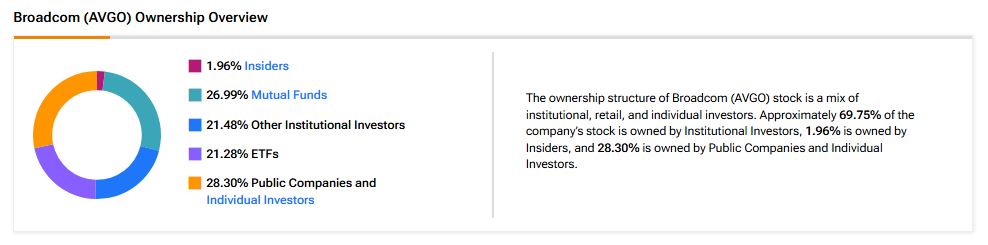

Now, according to TipRanks’ ownership page, public companies and individual investors own 28.30% of Broadcom. They are followed by mutual funds, other institutional investors, ETFs, and insiders at 26.99%, 21.48%, 21.28%, and 1.96%, respectively.

Digging Deeper into AVGO’s Ownership Structure

Looking closely at top shareholders, Vanguard owns the highest stake in AVGO at 8.91%. Next up is Vanguard Index Funds, which holds a 6.78% stake in the company.

Moving to Mutual Funds, Vanguard Index Funds holds about 6.78% of AVGO, whereas Fidelity Concord Street Trust owns 1.57% of the stock.

Among the top ETF holders, Vanguard Total Stock Market ETF (VTI) owns a 3.14% stake in Broadcom stock, followed by Vanguard S&P 500 ETF (VOO) with a 2.63% stake.

Is Broadcom a Good Stock to Buy?

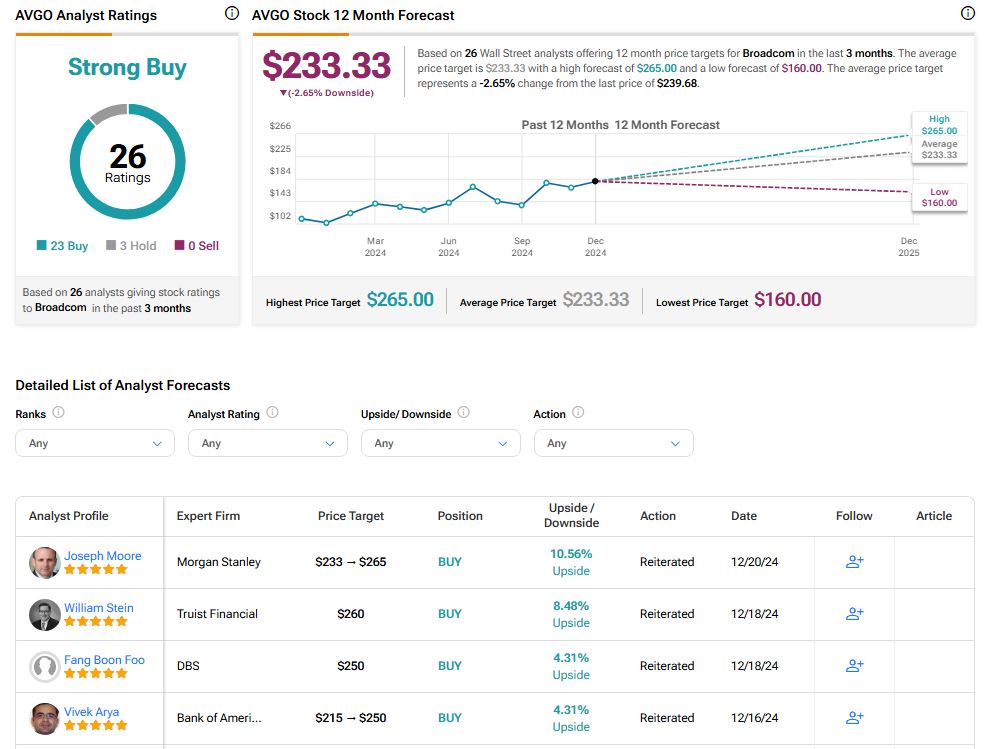

Turning to Wall Street, analysts have a Strong Buy consensus rating on AVGO stock based on 23 Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. The average AVGO price target of $233.33 per share implies 2.65% downside potential.

Conclusion

TipRanks’ Ownership Tab provides valuable insights into the category-wise ownership structure of the company, enabling investors to make well-informed investment decisions.