The stock of Brown & Brown (BRO) is up 2% after the insurance brokerage reported third-quarter financial results that beat Wall Street forecasts across the board.

The Florida-based company acts as a bridge between insurers and customers, helping consumers and businesses find insurance policies that meet their needs. For Q3 of this year, Brown & Brown reported earnings per share (EPS) of $0.91, which topped the consensus forecast of analysts that called for $0.88 in earnings. The profit was up 33% from a year earlier.

Revenue in the quarter totaled $1.19 billion, which edged out estimates of $1.17 billion. Sales were up 11% from a year ago. The company said that its commissions and fees increased 10% year-over-year during Q3, and that its organic revenue rose 9.5% from a year earlier.

Boom Times for Insurers

Brown & Brown has benefitted in recent years from a boom in the insurance industry as premiums for home and auto insurance, as well as property and casualty insurance, have increased. Brokerages such as Brown & Brown that receive commissions based on premiums paid to insurers have benefited from the renewed spending on policies.

BRO stock has risen 47% this year and is up nearly 200% over the last five years. The share price has increased steadily as the company has reported a string of better-than-expected financial results. The insurance industry is expected to benefit as central banks around the world further lower interest rates.

Is BRO Stock a Buy?

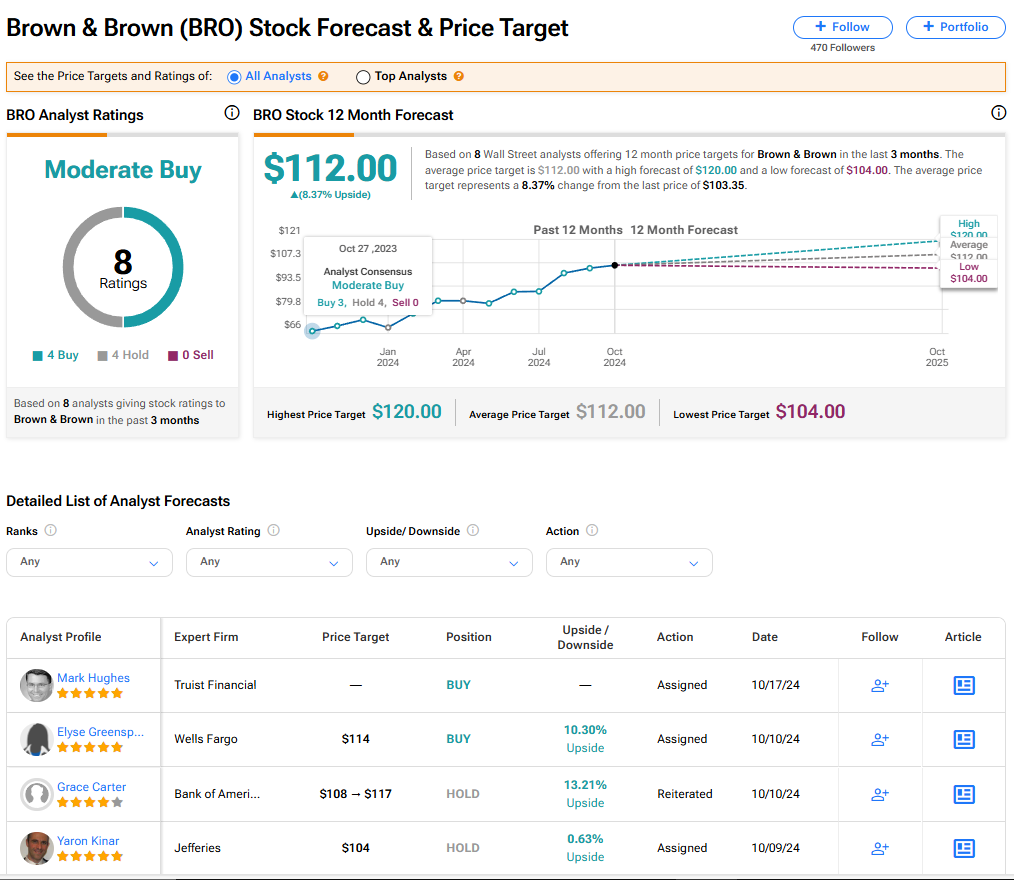

Brown & Brown stock has a consensus Moderate Buy rating among eight Wall Street analysts. That rating is based on four Buy and four Hold recommendations made in the last three months. There are no Sell ratings on the stock. The average BRO price target of $112 implies 8.37% upside from current levels.