Builder Vistry Group (GB:VTY) is close to sealing an agreement to buy Countryside Partnerships (GB:CSP) in a cash and stock deal valued at around £1.25 billion.

Don't Miss Our New Year's Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Once completed, the combined entity will be among the leading home builders in the country with a revenue potential of around £3 billion. The new business will focus on affordable housing projects.

The Synergy

Countryside shareholders will receive a total value of 249p per share, which is around 9.1% higher than the stock’s closing price on Friday.

The company failed to take advantage of booming house prices and disappointed the shareholders. As a result, the stock has fallen almost 60% in the last year and is currently trading at a five-year low.

Countryside was facing pressure from its biggest shareholder, the U.S.-based Browning West, to go private.

For Vistry Group, which owns brands such as Bovis Homes and Linden Homes, the deal will further strengthen its position in the industry and generate substantial cost savings. The company is targeting £50 million savings in cost annually, starting from two years of completion. Vistry’s shares have been trading down by 35% in the last year.

Vistry Group share price prediction

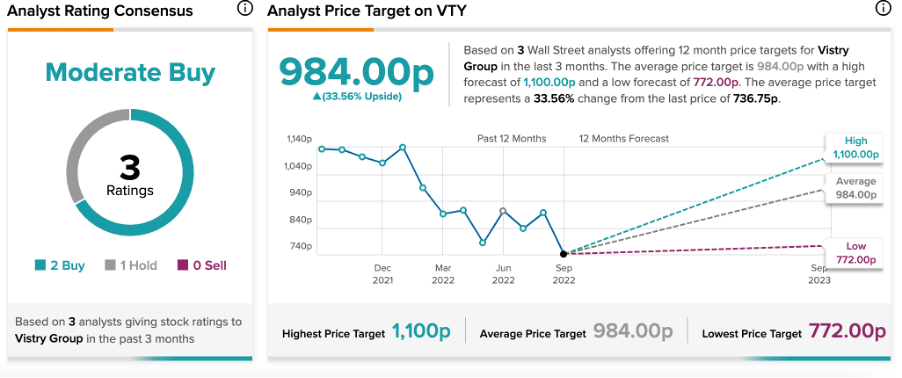

According to TipRanks’ analyst rating consensus, Vistry Group has a Moderate Buy rating. It has two Buy and one Sell recommendations.

The VTY price target is 984p, which represents a 34% change in the price from the current level. The price has a high and a low forecast of 1,100p and 772p, respectively.

Conclusion

With this deal, which is due for completion in the first quarter of 2023, both companies will be in a better position to navigate the slowdown affecting the housing market.