Energy giant Shell PLC (NYSE:SHEL) (GB:SHEL) intends to “evaluate” its investment plans of up to £25 billion in U.K. following the government’s decision to expand windfall tax on oil and gas companies. Last week, U.K.’s finance minister, Jeremy Hunt, announced that effective January 1, 2023, the windfall tax (called Energy Profits Levy) on oil and gas companies will increase from 25% to 35% and will be extended through March 2028.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The U.K. government, which is struggling with its finances, expects the Energy Profits Levy to generate nearly £40 billion over the next six years.

Shell to Evaluate Planned U.K. Investments

Speaking at the Confederation of British Industry’s annual conference in Birmingham, Shell’s U.K. chairman, David Bunch, said, “We’re going to have to evaluate each project on a case by case basis.” Bunch further stated, “When you tax more you’re going to have less disposable income in your pocket, less to invest.”

Earlier this year, Shell announced its plans to invest £20 billion to £25 billion in the U.K. energy infrastructure over the next 10 years. The company aims to direct more than 75% of these investments toward low and zero-carbon products and services.

Energy companies, like Shell, Exxon (XOM), and Chevron (CVX), have made significant profits this year as oil and gas prices spiked due to the Russia-Ukraine crisis. Recently, U.S. President Joe Biden also threatened oil giants with a windfall tax if they don’t increase their production and lower prices to address the impact of high inflation on consumers.

Is Shell a Buy or Hold?

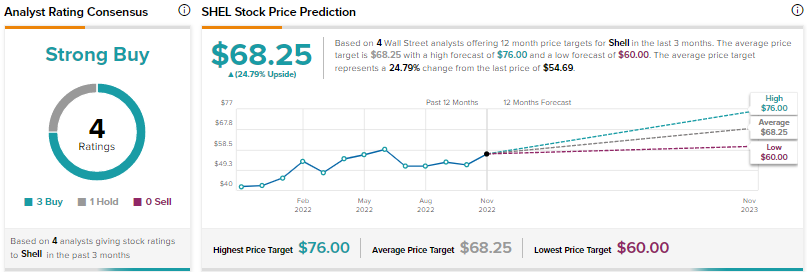

Shell stock scores the Street’s Strong Buy consensus rating based on three Buys and one Hold. The average SHEL stock price target of $68.25 implies nearly 25% upside potential. The U.S.-listed shares have rallied over 26% so far this year.