Bluebird bio Inc. (BLUE) said on Monday its partner Bristol Myers Squibb Co. (BMY) will pay $200 million to buy out future royalty obligations of its two jointly developed cancer therapies.

Under the terms of an amended agreement, Bristol Myers will pay Bluebird bio to buy out future royalty obligations on outside of the U.S. sales for its two treatments, ide-cel and bb21217, which belong to a group of drugs called CAR T immunotherapy.

“Our collaboration with Bluebird has resulted in the first CAR T cell therapy submitted for regulatory approval to target the B-cell maturation antigen and for multiple myeloma,” said Krishnan Viswanadhan, Senior Vice President, Global Cell Therapy Franchise Lead for Bristol Myers Squibb. “This amended partnership allows Bristol Myers Squibb to leverage our global manufacturing capabilities and consolidate all responsibilities outside the United States.”

The companies will continue to equally share profits and losses in the U.S., Bluebird said. Furthermore, Bluebird announced that it is currently in the process of building out its wholly-owned manufacturing facility in Durham, North Carolina for the production of lentiviral vector (LVV) to support the U.S. commercial market for ide-cel and for Bluebird bio’s pipeline. Over time, Bristol Myers will assume responsibility for vector manufacturing outside of the U.S.

Separately, Bluebird said its first-quarter net loss widened to $202.6 million from a loss of $164.4 million a year ago. Shares rose 1.5% to $60.19 in U.S. trading.

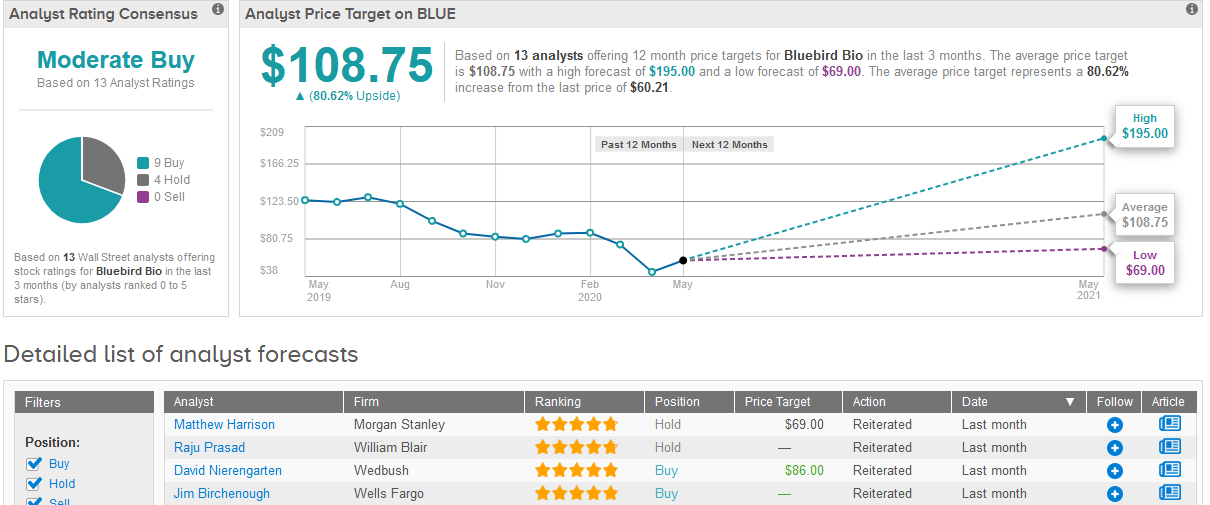

Five-star analyst Raju Prasad at William Blair maintained his Hold rating on Bluebird’s stock, saying that he is taking a “wait-and-see approach on the company’s expected commercial launches and earlier-stage programs”.

“Although the revised collaboration with Bristol Myers provides $200 million in non-dilutive funding to Bluebird, allowing the company to extend its cash runway from 2021 to 2022, it was slightly below our estimates of the value of all ex-U.S. royalties,” Prasad said in a note to investors.

Overall, Wall Street analysts have a Moderate Buy consensus rating on the stock based on 9 Buys and 4 Holds. The $108.75 average price target provides investors with 81% upside potential should the target be met in the next 12 months. (See Bluebird stock analysis on TipRanks).

Related News:

AstraZeneca, Daiichi Get FDA Breakthrough Status For Gastro Cancer Drug

Seres Therapeutics Reports Weak Earnings, But Significant Upside Lies Ahead

Inovio’s COVID-19 Vaccine Candidate Has the Edge Over Moderna’s, Says 5-Star Analyst