Healthcare giant Bristol-Myers Squibb (BMY) looks like the perfect place to wait out the extreme volatility that has hit the market this summer. This turbulent period peaked with the CBOE Volatility Index (commonly known as the VIX), which tracks market volatility through S&P 500 (SPX) options, soaring to its highest levels since the COVID-19 sell-off of 2020. The VIX dramatically rose from 23 on Friday to 65 on Monday.

Don't Miss Our New Year's Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

BMY has held up remarkably well during the recent downturn. While the tech-centric Invesco QQQ Trust (QQQ) is in correction territory after falling 9.6% over the past month, and the S&P 500 is down 4.3%, BMY is sitting pretty with an 18% gain.

I’m bullish on BMY due to its strong recent performance, surprisingly cheap valuation, and attractive 5.1% dividend yield.

Deceptively Cheap

BMY is deceptively cheap. The stock trades at a seemingly steep 65.3 times 2024 earnings estimates, but it’s important to note that this is because 2024 earnings are particularly low based on a one-time $6.30 per share charge related to recent acquisitions.

However, looking ahead to 2025, when these costs should be in the rearview mirror, consensus estimates call for the company to earn nearly $7 per share. This means that the company trades at a remarkably cheap valuation of just under 7x 2025 earnings estimates.

It’s hard to understate just how cheap this is. The S&P 500 trades at 23.8 times earnings. While it’s not an apples-to-apples comparison, given the different time frame, it still illustrates just how inexpensive shares of BMY are.

BMY is also considerably cheaper than Pfizer (PFE) and Merck (MRK), two of its large-cap pharma peers that I would consider to be bona fide deep-value stocks themselves.

Pfizer shares are attractively valued at 11.4 times 2024 earnings estimates (and 10.5 times 2025 estimates), while Merck is attractively valued at 13.7 times 2024 estimates (and 11.5 times 2025 estimates). Thus, both of these Healthcare giants are cheap, but BMY looks significantly cheaper, going forward.

This cheap valuation makes BMY especially attractive at a time when growth stocks with higher multiples are selling off.

To be fair, the stock is not without its challenges, which is part of the reason for this low valuation multiple. One key concern surrounding Bristol-Myers is that several of its important older drugs, like Opdivo and Eliquis, face increased competition from lower-priced generics as they reach their patent cliffs. Its popular drug, Revlimid, already finds itself in this situation. However, these concerns look like they are already priced into the stock at these levels.

Plus, the company has newer drugs in the pipeline that show promise. It has also made a number of recent acquisitions (such as Karuna Therapeutics) and is cutting $1.5 billion in costs by 2025 that will be reinvested back into R&D. This should help it combat the loss of exclusivity for some of its current portfolio.

Big-Time Dividend

In addition to this inexpensive valuation, BMY is an awesome dividend stock with a formidable yield of 5.1%.

This type of yield is compelling in and of itself, but especially so when considering that the S&P 500 currently yields 1.4% and that the average yield for the healthcare sector is a similar 1.5%.

The dividend appears to be well-covered by the company’s free cash flow, and BMY has been a very consistent dividend stock. It has paid this dividend for 34 consecutive years and increased the size of its payout for the last seven years in a row.

Is BMY Stock a Buy, According to Analysts?

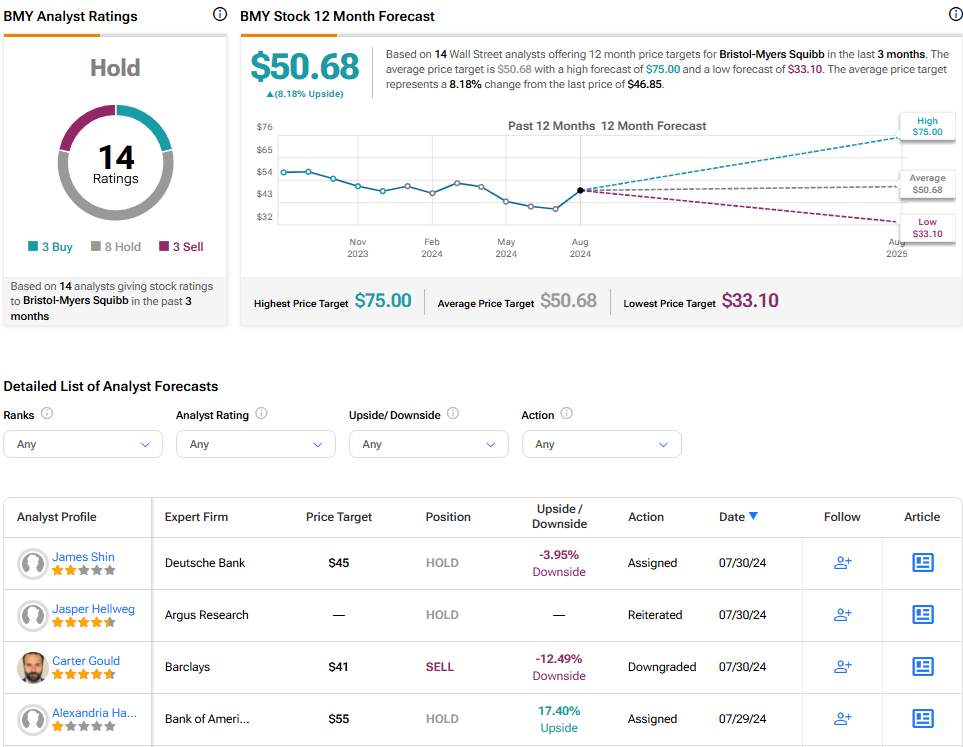

Turning to Wall Street, BMY earns a Hold consensus rating based on three Buys, eight Holds, and three Sell ratings assigned in the past three months. The average BMY stock price target of $50.68 implies 8.2% upside potential from current levels.

The Smart Play

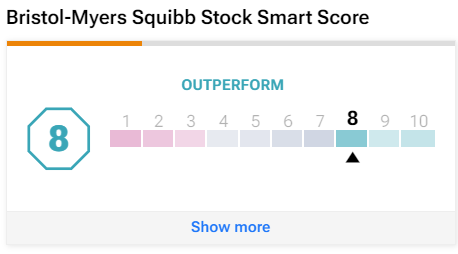

BMY is highly rated by TipRanks’ proprietary Smart Score system, which gives it an Outperform-equivalent 8 out of 10 rating.

The Smart Score is a quantitative stock scoring system created by TipRanks. It gives stocks a score from one to 10 based on eight key market factors. Scores of 8, 9, or 10 are considered equivalent to an Outperform rating. The score is data-driven and does not involve any human intervention.

The Takeaway

The market has been volatile, but BMY has been a port in the storm. It posted excellent second-quarter earnings results and gained 18% over the past month while the broader market has struggled. Despite this impressive run, the stock still looks incredibly cheap. I’m bullish on BMY based on this inexpensive valuation and its ample 5.1% dividend yield.