Shares in Xeris Pharmaceuticals are rising 9% in Wednesday’s pre-market session after the company announced that the US Food and Drug Administration (FDA) granted Fast Track designation for its XP-0863 injection used in the treatment of acute repetitive seizures.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Xeris (XERS) said that the complete results of the Phase 1b study were shared with the FDA. The US regulator provided feedback that Xeris’ drug development program for XP-0863 could advance directly into a Phase 3 registration study in both pediatric and adult patients with epilepsy.

There are over 2.7 million people with epilepsy in the US with about 200,000 new patients diagnosed each year. About 30% and 40% of these patients are uncontrolled on oral therapy and are at risk for acute breakthrough seizures.

“The FDA’s Fast Track designation highlights the clear unmet need in treating acute repetitive seizures with the preparations of diazepam available today and highlights our opportunity to dramatically improve care through the introduction of a ready-to-use injection formulation,” said Xeris CEO Paul R. Edick. “We are working to identify the right development and commercialization partner who can accelerate our efforts to evaluate and deliver this simple format that could make all the difference in an urgent seizure setting.”

XP-0863 was previously granted orphan designations both for the treatment of acute repetitive seizures and for the treatment of Dravet Syndrome.

Xeris’ lead product, Gvoke, is a ready-to-use glucagon product for diabetic patients experiencing severe hypoglycemia, which has been approved as a prefilled syringe (PFS) and autoinjector (HypoPen). The HypoPen was launched on July 1, making it the first ready-to-use glucagon in a premixed autoinjector, with no visible needle. Hedge fund tycoon and billionaire George Soros has a 5.3% stake in the company.

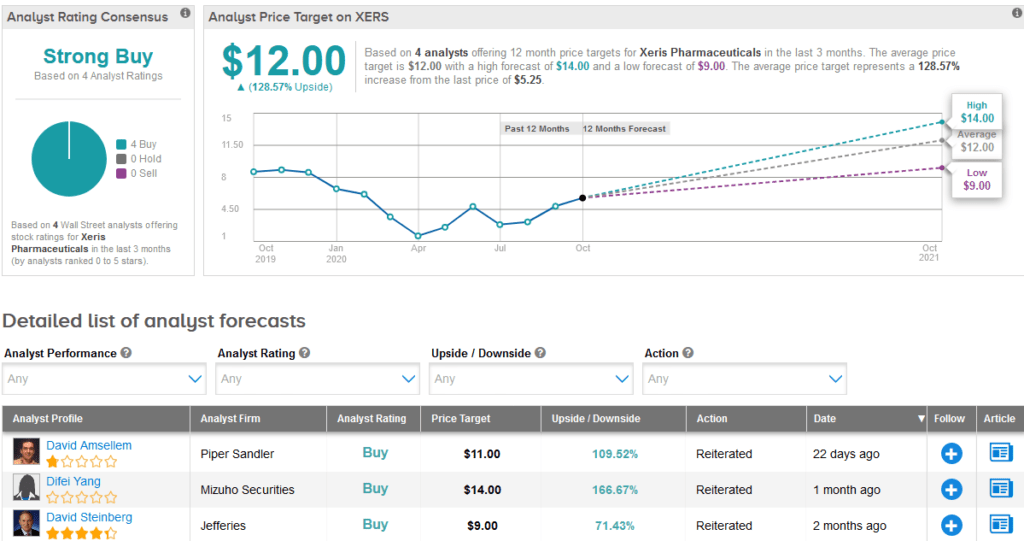

Piper Sandler analyst David Amsellem recently reiterated a Buy rating on the stock with a $11 price target following favorable feedback from a physician survey to gauge perceptions of Xeris’ Gvoke.

“The feedback, on the whole, points to significant growth in the footprint of Gvoke, particularly in the context of a glucagon rescue space that historically has been vastly underpenetrated,” Amsellem wrote in a note to investors. “We continue to believe that peak US sales for the Gvoke franchise of $250M+ are realistic, with upside to the extent that label expansion opportunities bear fruit (e.g., post-bariatric surgery patients).”

“This translates into an attractive risk/reward profile at a market cap of under $300M,” the analyst summed up. (See XERS stock analysis on TipRanks).

Overall, the stock boasts a Strong Buy Street consensus, with 4 recent Buy ratings. With shares down 26% this year, the $12 average analyst price target implies a promising 129% upside potential.

Related News:

AbbVie Submits US, EU Rinvoq Applications For Atopic Dermatitis

Pfizer Targets FDA Approval For Covid-19 Vaccine In November; Shares Rise

Merck Nabs Expanded Keytruda Label For Hodgkin Lymphoma