Morgan Stanley raised Tesla’s (TSLA) price target on Wednesday to $1,050 (30% downside potential) from $740 and reiterated a Sell rating on the stock.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Morgan Stanley analyst Adam Jonas said that it is “becoming increasingly obvious that Tesla is going to become a very large company.” He expects Tesla’s “revenue can approach if not exceed that of Toyota or Volkswagen in the next decade.” He has also raised his revenue forecast for 2030 to over $170 billion and assumes 3 million units of production volume to support the revenues.

However, Jonas noted that “the current share price discounts roughly 5M units, and implies as much as 10% of industry revenues and roughly 20%-30% of industry profit,” which is why he has a Sell on Tesla.

In a note to investors on Tuesday, Bernstein analyst Toni Sacconaghi pointed out that Tesla’s “EV (enterprise value) has now matched Toyota and Volkswagen combined (who collectively make 20M cars vs. Tesla at 500K) and is up nearly 500% in less than a year – unprecedented for a large-cap stock outside of the tech bubble”. The high valuation led Sacconaghi to downgrade the stock to Sell from Hold, while reiterating a price target of $900 (about 40% downside potential).

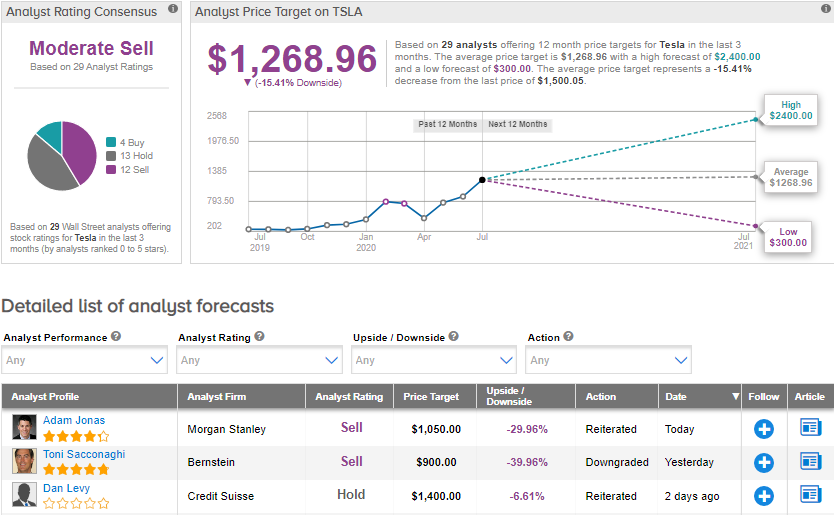

Currently, the Street has a Moderate Sell analyst consensus is based on 12 Sells, 13 Holds and 4 Buys. The average price target of $1,268.96 implies a downside potential of 15.4%. (See TSLA stock analysis on TipRanks).

Related News:

Bernstein Turns Bearish On Tesla

Tesla’s Elon Musk Is Open To Offering Software And Batteries To Competitors

Tesla Gains 4% After-Hours On Upbeat Q2 Earnings